No one wants to have an accident but sometimes it is unavoidable, and even if you are not seriously injured, your vehicle is likely to be damaged. After getting over the initial shock comes the part of having to negotiate and make on-the-spot decisions as numerous touts and tow-truck operators suddenly appear around you. And then there’s the process of making a police report and then an insurance claim.

Each day, many motorists go through such experiences and in order to reduce the stresses, diligently choosing the right motor insurance coverage and company is important. It can make all the difference, especially as many insurance companies offer value-added services as well. No longer do you just get coverage for loss or damage but additional benefits as well.

According to Allianz Malaysia Berhad’s CEO, Zakri Khir, the solution lies with car owners being diligent in understanding the importance of comprehensive insurance coverage and choosing services that resonate best with their needs.

“Anyone who has been in a motor accident will tell you what a painful experience it can be when it comes to settling claims and getting repair works done on time. Should things turn sour, more often than not, insurers are pegged as the bad guy, seemingly profiting from another’s misfortune,” he said.

“However, what most fail to see is that accidents are a litmus test for us insurers and the promise we sell to our customers that we will be there for them in their times of need. Not delivering on those promises is a cardinal sin. The onus is on the insurer to honour its promise to its customers and at Allianz Malaysia, we are about doing things right by you, providing the services that you need at the times that you need them the most,” Encik Zakri said.

“No one ever thinks about accidents when renewing their insurance and road tax. Moreover, you want it to be the quickest transaction, so you can legally drive again. But the reality is accidents happen when we least expect them. So it is important to understand how good motor insurance and the services offered by an insurer can help you in these circumstances. Opting for the bare minimum is never the answer because you are inadvertently depriving yourself of the adequate protection you deserve,” advised Damian Williams, Head of Claims at Allianz General Insurance Company (Malaysia) Berhad.

Although the Movement Control Orders (MCO) saw fewer vehicles on the road last year, the Royal Malaysia Police (PDRM) reported that there were 418,237 road accidents reported in 2020. The Allianz Road Rangers, the company’s free accident assistance service for its customers, provided roadside assistance to 67,000 customers nationwide in 2020, with an average response time of 30 minutes for tow-truck services in the Klang Valley.

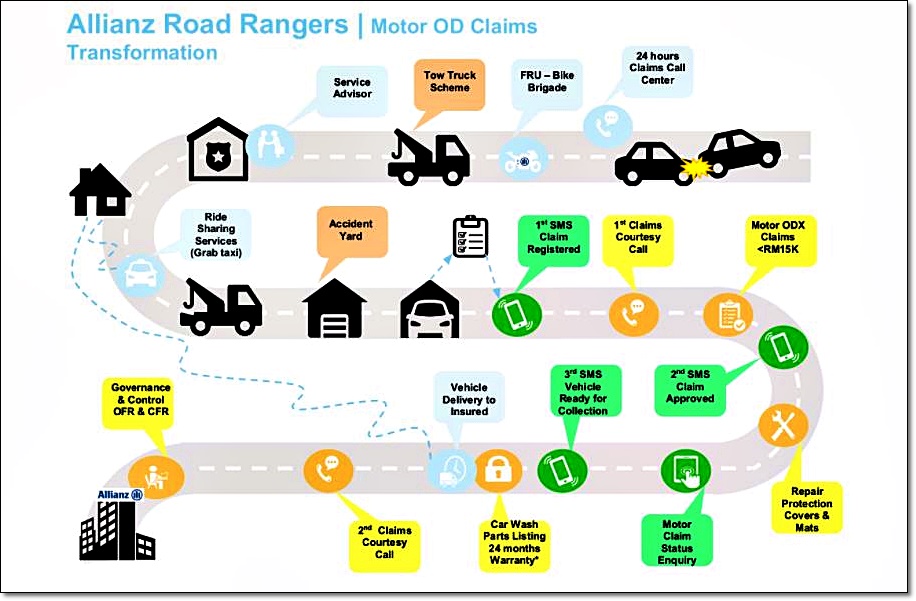

Launched in the Klang Valley in 2017 and available nationwide since 2018, the Allianz Road Rangers service includes 24-Hours Helpline Assistance; the Allianz Road Ranger fleet (First Response Bike Brigade and Allianz Tow Truck; Claims Concierge Service; e-hailing Voucher; Claims Express Approval, and Vehicle Delivery. To date, the fleet has 190 vehicles, with 30 motorcycles as well.

Last year, in a move to enforce transparency and improve its customer journey experience, Allianz General revamped its panel of Authorised Repairers to consist of PIAM Approved Repairers Scheme workshops, via an e-tender. While the move had a ripple effect, the company now has 195 panel workshops nationwide. Besides that, the company also offers a 2-year warranty for repair work carried out (including the spare parts used) on vehicles involved in accidents.

Stopping motor claim fraud

Encik Zakri also revealed that motor claims have become a billion-ringgit scam in Malaysia. Citing an ecosystem that breeds fraud and corruption as one of its main reasons, there is a strong call for better awareness and he issued a ‘call to arms’ for other industry players to play their role in stopping corrupt practices.

“There are many parties that monetise motor claims to their own benefit under a cloud of lack of clarity and mystery surrounding the whole motor claims process that most customers are not wise to it. This gets magnified when customers do not know their rights as consumers – that your insurer is there to serve your needs, not the other way round,” said Encik Zakri.

In developing the Allianz Road Rangers service and its touchpoints, the focus was on serving customers and minimising fraud. “We knew we had to buck up to remove any element or opportunity for fraud and pay out genuine claims. Our customers must know that we will not partake nor condone any devious activity. The entire Allianz Road Rangers journey from the accident assistance service to claims, vehicle repairs, and the selection of workshop repairers is our way of having a structured delivery of service that is visible to our customers,” he said.