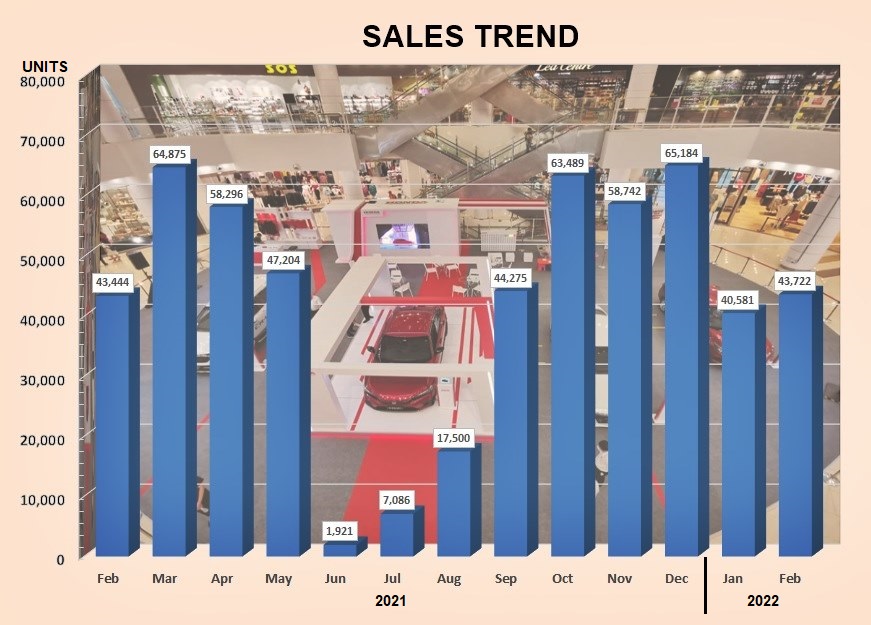

Historically, February is a ‘low’ month as it has the least working days of the year and often, there are also major festive periods during the month, further reducing the number of selling days. However, February in 2022 bucks the trend and saw an 8% increase over January sales to close at 43,722 units. Compared to 2021, the Total Industry Volume (TIV) was quite close, with a difference of 274 units.

The surge in sales (or more correctly deliveries) was due to the big backlog of orders being fulfilled as much as possible. The severe floods in December had caused shortages in the supply chain as some parts suppliers had to suspend operations due to their factories being flooded. This resulted in the TIV for January being lower than it should have been and as supplies resumed, the plants quickly rushed to complete vehicles, and send them to dealers.

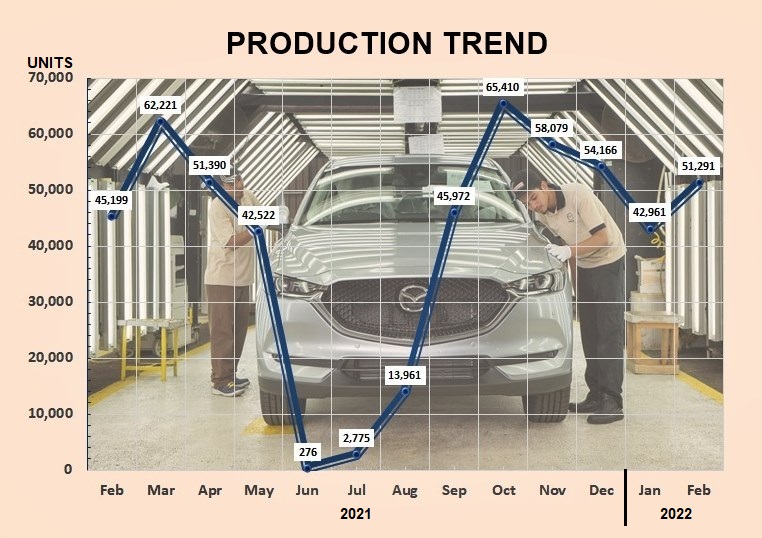

The resumption of regular production was reflected in the high output of vehicles from plant in February – 51,291 units, which was 13% more than for the same month in 2021. 92% of the output was passenger vehicles. There are still constraints to production due to the global shortage of microchips and the backlog continues as it is beyond control of assemblers and suppliers.

The upward trend is expected to continue through March which has more working days. The companies still have many outstanding orders to fulfill, while new models are being launched every month. March is also the final month of the financial year for some companies, so they will be pushing hard to finish off with their best possible numbers.

As for cumulative TIV, this year looks like it will be a better year if the performance – in spite of shortages – is any indicator. Within just the first two months, the TIV for sales is 10% higher than the same period in 2021, while the TIV for production is 11% higher. Sales of commercial vehicles (including pick-up trucks) is 33% higher, suggesting that companies are confident enough to expand or update their fleets in anticipation of improving business.

Perodua to surge forward in 2022 with RM1.326 billion investment