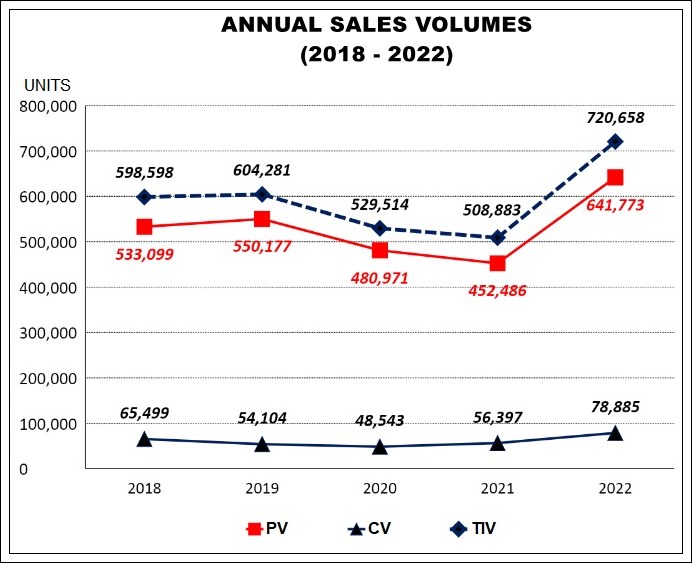

After the very difficult time in 2021 and 2020, especially the latter which was severely impacted by the lockdown measures to fight COVID-19, the Malaysia auto industry’s sales rocketed to a record high in 2022. With a Total Industry Volume (TIV) of 720,658 units of new vehicles sold and a total production volume of 702,275 units, the industry hit the highest ever numbers in its history which goes back to 1967 (when local assembly began). It’s also the first time that the 700,000-unit has been crossed in both sales and production, noted the Malaysian Automotive Association (MAA) which compiles the data annually.

Factors that boosted sales

A number of factors contributed to this achievement besides lifting of the constraints caused by the pandemic which had depressed sales in 2020 and 2021. With steady economic recovery in 2022, sales rose quickly and although demand was high, supply was short in the first half of the year due to production disruptions. These disruptions were caused by shortage of parts, especially microprocessor chips, a situation that affected the global auto industry.

The sales boost was also due to many wanting to take advantage of the sales tax exemption that the government had provided to help the industry recover. The exemption was set to end on June 30, 2022 and there was therefore a surge in orders which companies were unable to fully fulfill due to shortages of vehicles. But the government has given up to March 31, 2023 for deliveries to be completed for the tax exemption to still be allowed (provided the booking was done before the cut-off date).

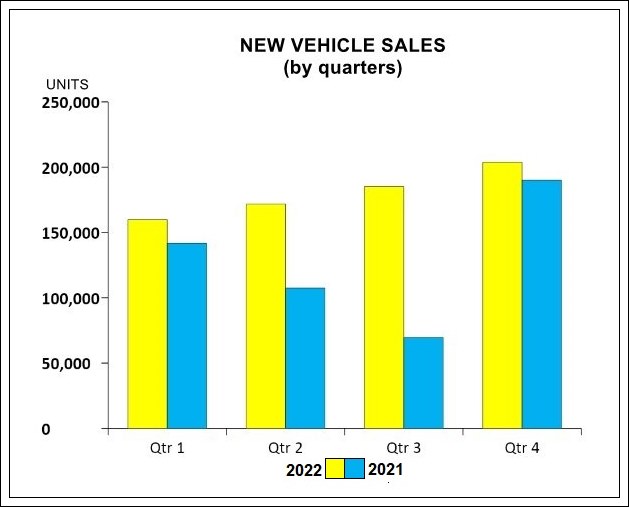

The 41.6% increase in TIV would have to be seen in the context of 2021’s TIV having been low at 508,883 units, having been dragged down by the drop in sales in June and July due to the extended lockdown suspending activities. In 2022, other than January and February, monthly sales volumes have been above the 50,000 unit mark, with December having recorded the highest TIV of the year – 76,657 units.

The Passenger Vehicle (PV) segment, which consists of passenger cars, window vans, SUVs and MPVs, accounted for 89% of the TIV with the Commercial Vehicle (CV) segment (which included pick-up trucks) being 11%. Although the percentage of CV sales remained the same in 2022, the volume was higher in tandem with the rise in overall TIV.

SUVs accounted for 30% of sales

Where MPVs used to be the second bestselling vehicle type in the PV segment, this category has no dropped to third with SUVs moving up in their place. This mirrors global trends for many years now and in 2022, SUVs accounted for 30% (194,038 units) of PV sales. As most pick-up trucks are bought for private use these days, this category should really be in the PV segment but due to harmonization with the other countries in ASEAN where pick-up trucks are classified as CVs, the MAA does likewise for the Malaysia data.

Although electric vehicles (EVs) have been available in Malaysian for many years and sold in very tiny numbers, 2022 saw battery electric vehicles (BEVs) starting to be sold in bigger numbers. This was due to the government allowing full tax exemption on BEVs to make them more ‘affordable’ and spur market adoption. As the exemption was only announced late in 2021, planning and ordering of vehicles from overseas took a while so the 2,631 units registered during the year are not indicative of the real demand which was higher.

The move towards BEVs is being encouraged by the government to address climate change by moving towards carbon neutrality. The tax exemption and other incentives are aimed at speeding up adoption but the reality is that BEVs still have fairly high prices due to the relatively young technologies they use. As can be seen, even when taxes are not factored in, the cheapest can only be around RM140,000. In order for mass adoption, BEVs would need to be priced at Vios level, if not Myvi level – and that’s very difficult.

The exemption is only up to the end of this year and the end of 2025 if a BEV model is assembled locally (Volvo Car Malaysia has done so with its Recharge models). Though it helps in some ways, the period is short and there is the danger that when the incentive is removed and prices of BEVs shoot high up again, people will just ignore them. This is what happened 10 years ago when a similar incentive was given for electrified vehicles; after the incentive stopped, so did sales.

Datuk Aishah Ahmad, the MAA’s President, said that the industry would prefer a longer period as big investments need to be made. A longer period would give investors more confidence as they can plan for the long-term, rather than what appears to be a year-to-year review that makes things uncertain.

Hybrids are a better bet and a number of models are already assembled locally now, allowing their prices to be lower. In 2022, almost 20,000 vehicles with hybrid powertrains were sold. These included models like the Toyota Corolla Cross Hybrid, a few Honda models (City, Civic, HR-V) as well as the Nissan Serena.

Looking ahead

The record TIV of 2022 is actually a bit of a ‘flash in the pan’ and will be seen as an anomaly in years to come. It happened for the reasons explained earlier although there’s no doubt that the volume would have risen higher over three years. The MAA does not expect a higher figure in 2023 and has instead made a more cautious forecast of 650,000 units which is 9.8% lower than 2022’s TIV.

Explaining the forecast, Datuk Aishah said that the MAA considered the slower economic growth globally as well as continuing supply chain issues, and the pandemic is also not over yet. Sales numbers will be high at least for the first quarter of the year because companies will be rushing to deliver the vehicles ordered before the end of June 2022. In fact, some companies have this as the top priority and customers who booked later will have a slightly longer wait.