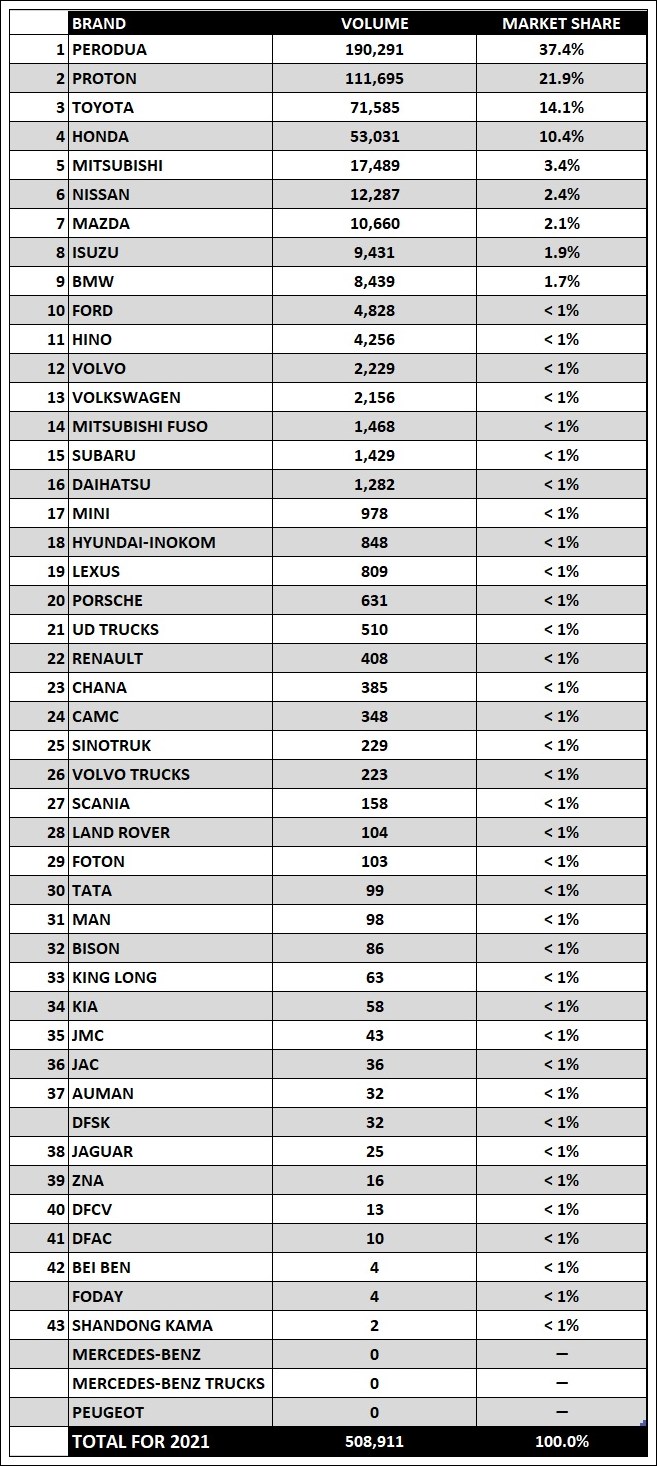

When it comes to commercial vehicles, Isuzu is the ‘King’ and evidence of this is shown by its consistently dominant position in the Malaysian market for many years. 2021 was no exception and once again, the brand retained two titles – for Malaysia’s top-selling truck for the 8th consecutive year, and for the best-selling light-duty truck for a 12th straight year.

These accomplishments were delivered through the total combined sales of 4,808 units of trucks in all segments and 4,545 units of light-duty trucks that were recorded in 2021.

“We are extremely thrilled to be able to achieve and retain the top spot again for overall truck and light-duty truck categories which our Isuzu brand has been privileged enough to enjoy for so many consecutive years in this market,” said Koji Nakamura, CEO of Isuzu Malaysia Sdn Bhd.

“These achievements demonstrate the continuation of our robust footprint and growth in Malaysia, as well as our ability in positioning ourselves to harness the opportunities whilst tackling the challenges amidst a pandemic-laden market situation. It is also particularly significant given how this situation had caused supply chain disruptions such as scarcity of raw materials which has impacted production in the trucking industry,” he said.

Extensive dealer network

Mr. Nakamura added that another key factor which had significantly contributed to the brand’s continuous market leadership is its extensive dealer network across the country. Regular communications between the head office and dealer partners has, over the years, fostered a strong relationship which enabled Isuzu Malaysia to capture on-ground market intelligence and deliver what customers need.

Dealers in close contact with customers

“Our dealers have a closely established rapport with our customers and were able to constantly gather feedback about the customers’ business situation and trucking solutions requirements. With these crucial ‘on-ground’ market information, our sales and aftersales teams could identify where the gaps are and work towards maintaining the strength of their respective operations for the benefit of our customers,” explained Atsunori Murata, Chief Operating Officer of Isuzu Malaysia Sdn Bhd.

Mr. Murata said that, prior to the pandemic, Isuzu Malaysia’s management team used to make regular face-to-face visits to its dealerships, business partners like body builders and transporters, and customers. However, due to the ‘New Normal’, this had to be immediately re-strategized by optimizing digital communications platforms for its marketing efforts such as creating videos on You Tube and Facebook, disseminating SMSes and holding meetings using Microsoft and Google conferencing tools. All these were done to ensure continuity of relationship-building and promotion of new products and services for easy understanding of Isuzu’s offerings.

In the last 2 years, Isuzu Malaysia had rolled out several strategic initiatives such as partnering with new dealers and opening of new centres; introduction of new product innovation which is the ELF range with Isuzu Safety Plus for greater safety and efficiency; plus on-time truck delivery to customers.

The company said all these had helped in further meeting the trucking solutions needs of customers and enhancing their satisfaction through market reach and quality service, which are pivotal in maintaining its robust truck sales and market-leading position.

Greater efficiency and safety

“We are grateful that our Isuzu brand continues to enjoy high demand as more customers experience the performance and comfort of our trucks. Since we introduced the new ELF range with Isuzu Safety Plus 2 years ago featuring a combination of safety system upgrades and B20 biodiesel compatibility, our customers have experienced greater efficiency and safety,” Mr. Murata revealed.

“Overall, Isuzu Malaysia is very honoured to share our success with everyone in our dealer network and employees because without their strong passion, dedication and outstanding work for the brand, achieving a market-leading position year-on-year would be a tough feat. Equally, we are also extremely appreciative to all our customers and we will continue to remain focused on providing more excellence and value through outstanding products and services to support their varied trucking needs,” said Mr. Murata.

For more details on Isuzu’s range of vehicles and to locate an authorised dealership in Peninsular or East Malaysia, call 1-300-88-1133 or visit www.isuzu.net.my.

Isuzu Elf range enhanced with extra safety features, B20 compatibility and longer warranty