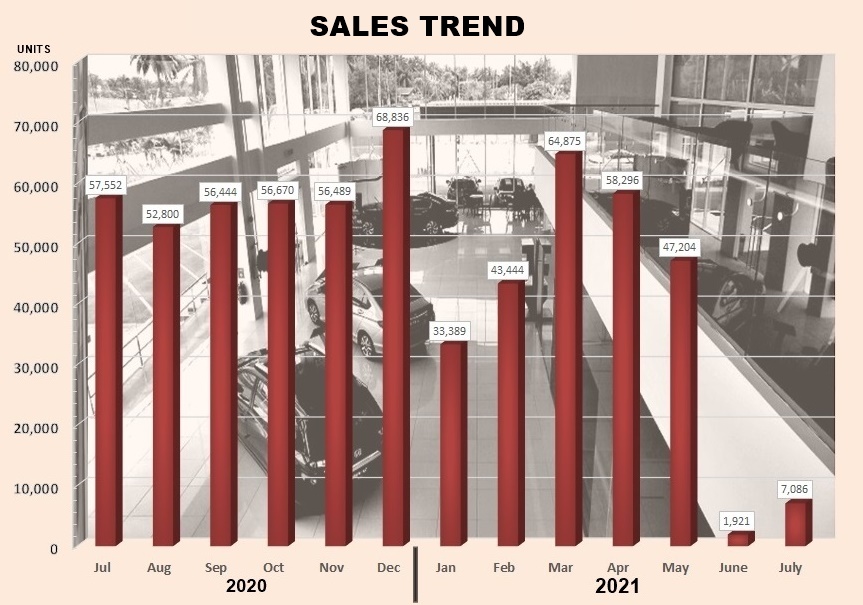

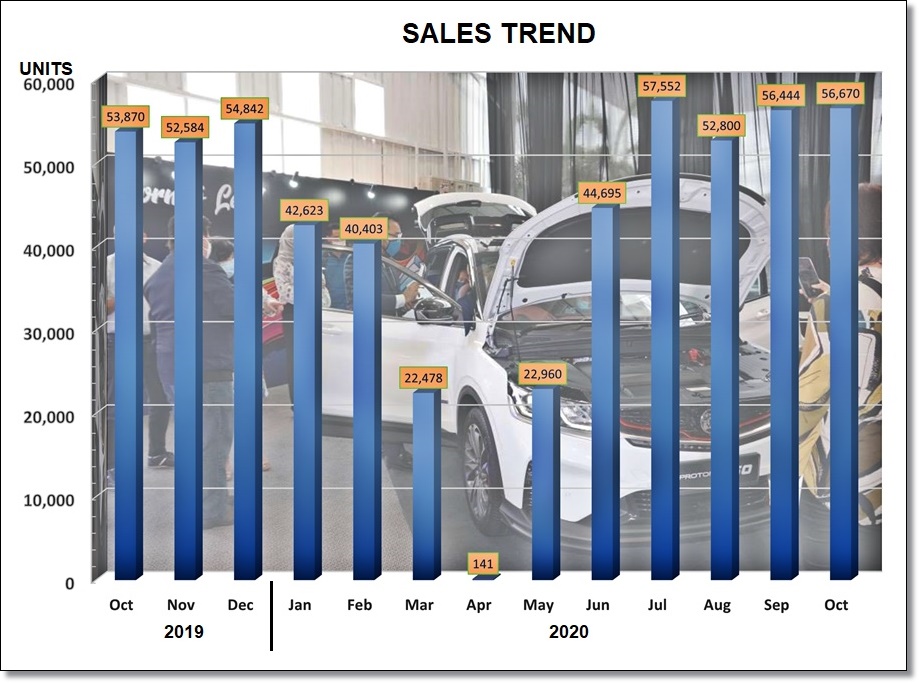

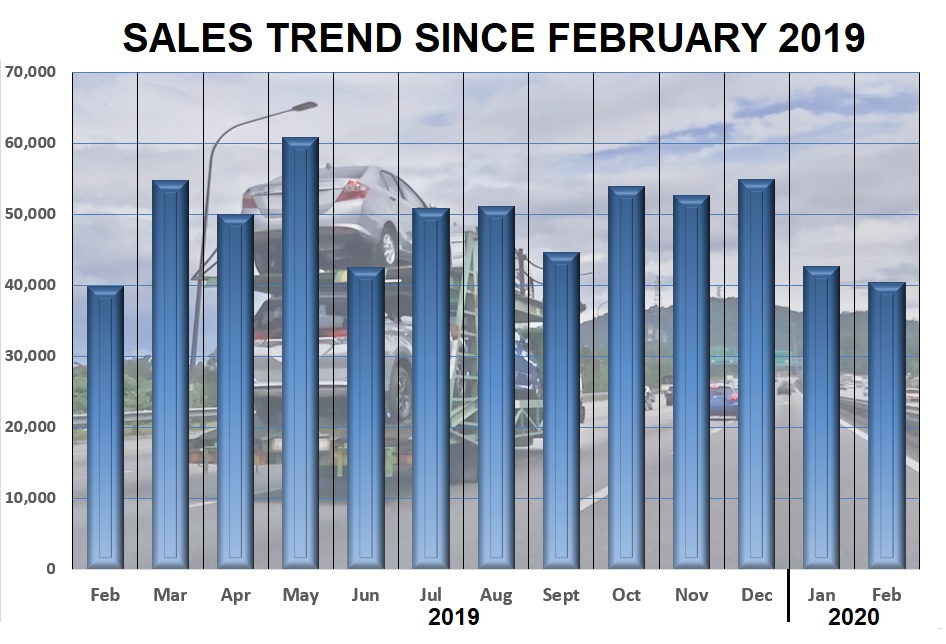

As expected, new vehicle sales in July 2021 were way down, though not as rock-bottom as June when the Total Industry Volume (TIV) was under 2,000 units. As in June, the continued closure of showrooms meant that no sales could be conducted and even if they could, registering the vehicles would not be possible. However, July’s TIV was 270% or 5,465 units higher as showrooms could operate in Sabah and Sarawak so sales were possible there and accounted for the higher numbers.

Minimal bookings from online channels

According to the Malaysian Automotive Association (MAA), which has been compiling data since the 1960s, members reported that bookings via online channels were minimal. These ‘virtual showrooms’ started to appear over the past year as stricter SOPs were in force and there was also concern that customers might not be comfortable coming to showrooms. Customers can make bookings and make payments via online transfers to at least start the process. However, there are still the other things like loan applications which still need some personal interaction.

The cumulative TIV after 7 months reached 256,215 units this year, which was about 10% higher than for the same period in 2020 – and this has been with 2 months of virtually no sales. With sales resuming from mid-August, there will be a backlog to clear plus new orders so the TIV by year-end might still be higher than for 2020.

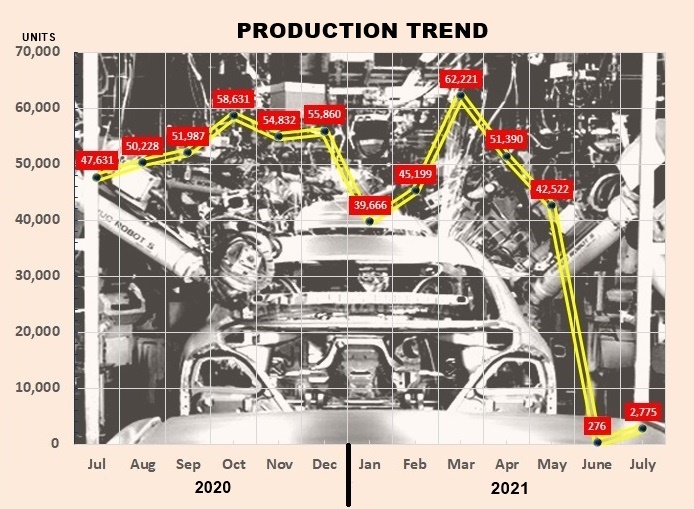

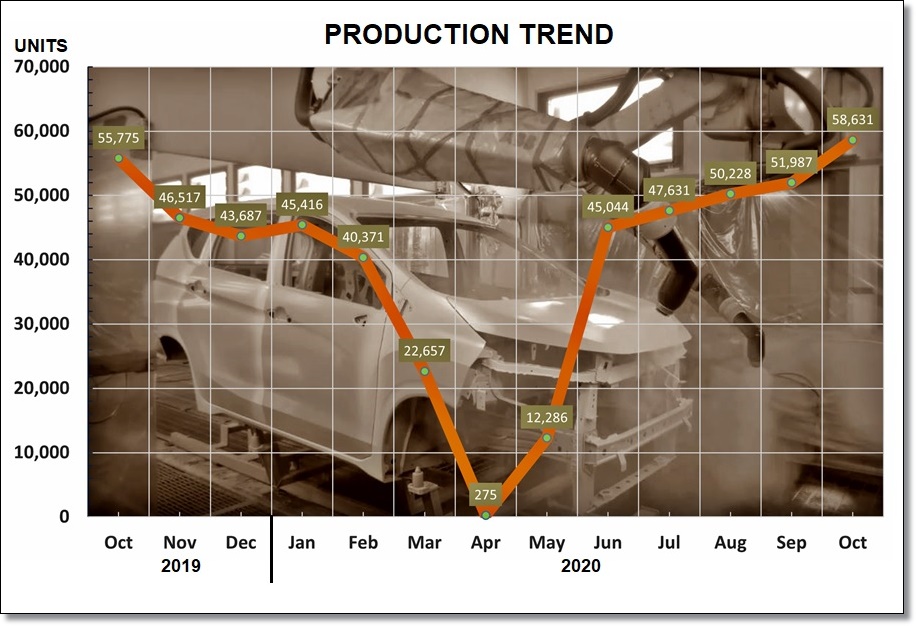

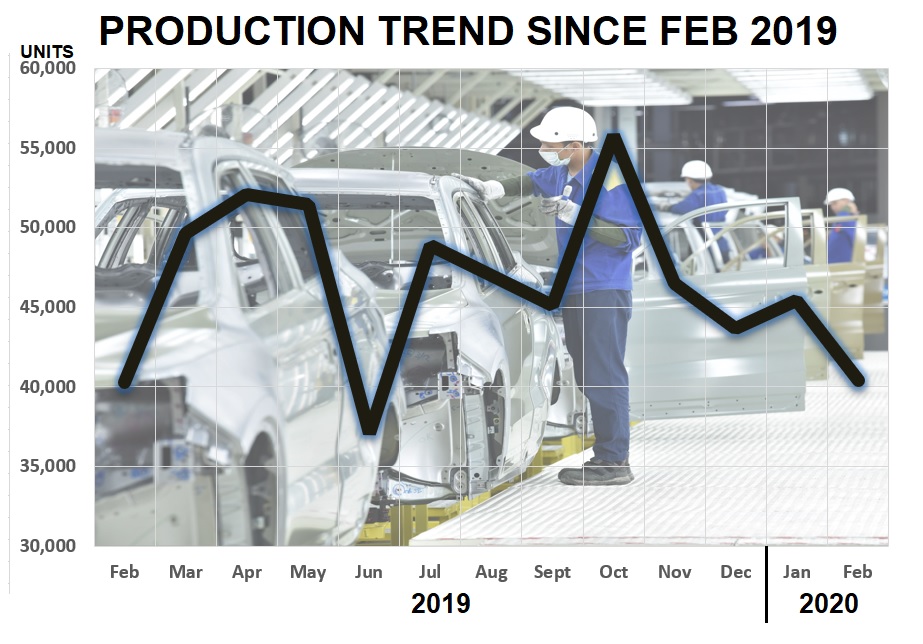

3-digit production figures

On the production side, the assembly plants have had to suspend operations too and the output fell to three digits in June but rose again in July. The disruption has been challenging for the plants which very much prefer consistent assembly. The shortage of microchips is also slowing output and as the end of the year nears, pressure will be on to deliver as many vehicles as possible because car companies are using the sales tax exemption as a selling point. It expires at the end of this year so many will want to make sure they can enjoy those savings.

Will sales pick up again?

Looking ahead, the MAA expects August sales to be better although there are only two weeks to the end of the month for sales. Furthermore, given the current situation in the country, not only with the pandemic but also the political situation, consumer sentiment may be cautious, and people will be reluctant to spend a lot.

According to MAA President, Datuk Aishah Ahmad, total losses for the local auto industry for the months of June and July have been estimated to be more than RM14 billion. “This is just only from sales of vehicles in the domestic market. Our members also lost much in terms of revenue from exports of vehicles and components, and sales of spare parts locally. All in all, these losses had been very substantial and unprecedented”, she said.

Car showrooms, accessory stores and carwash centres can resume operations from August 16