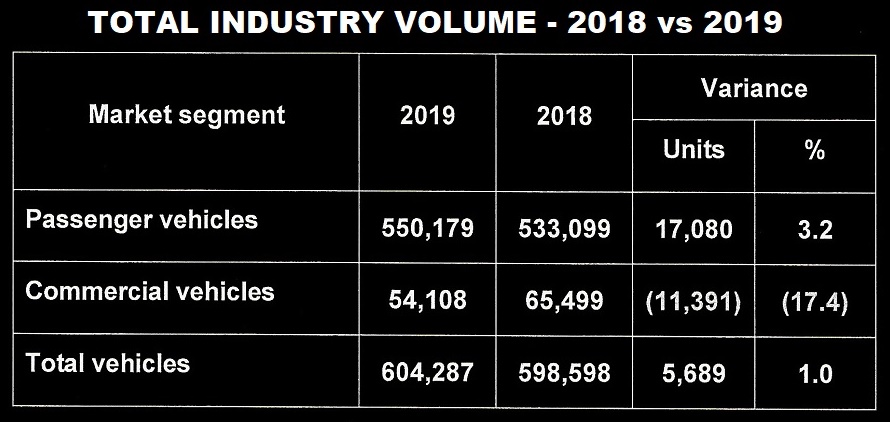

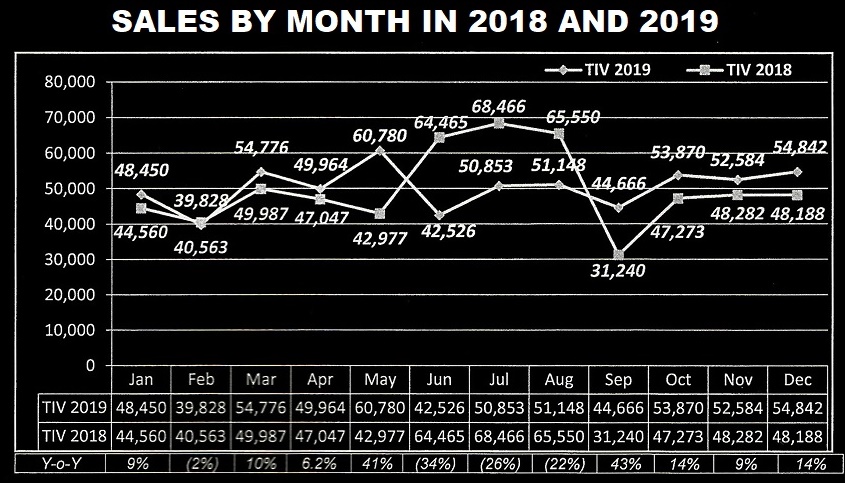

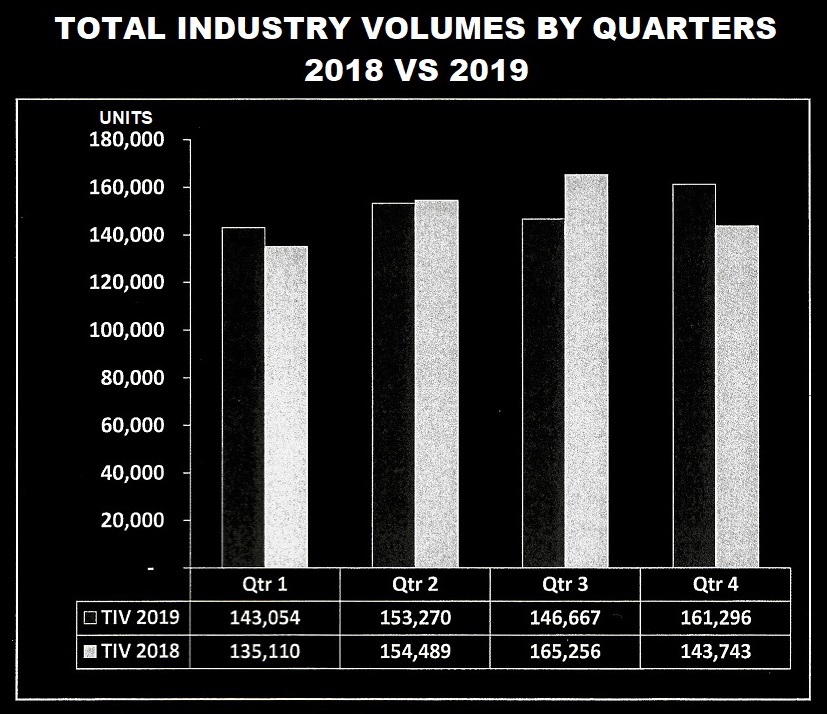

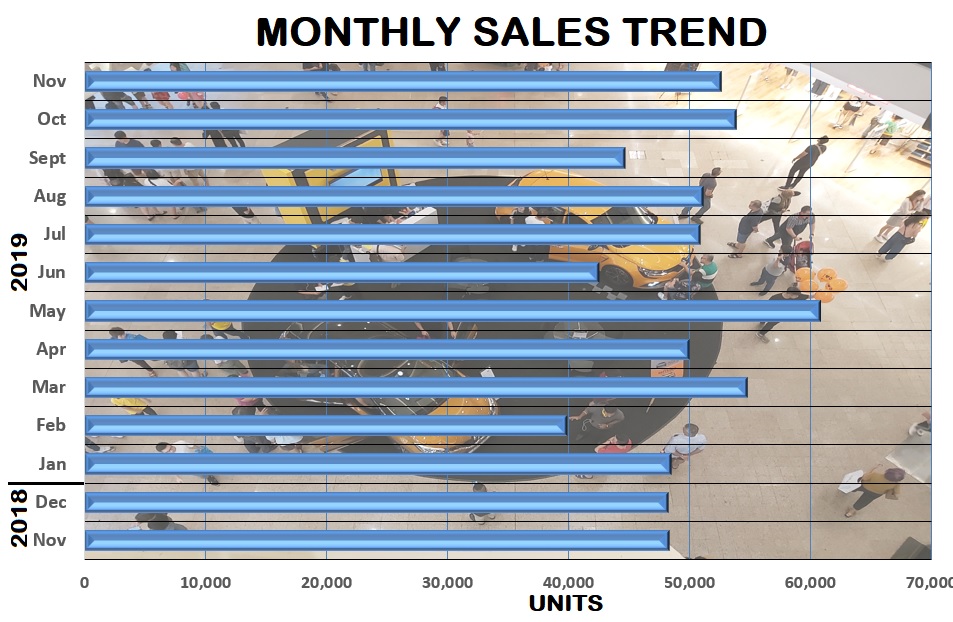

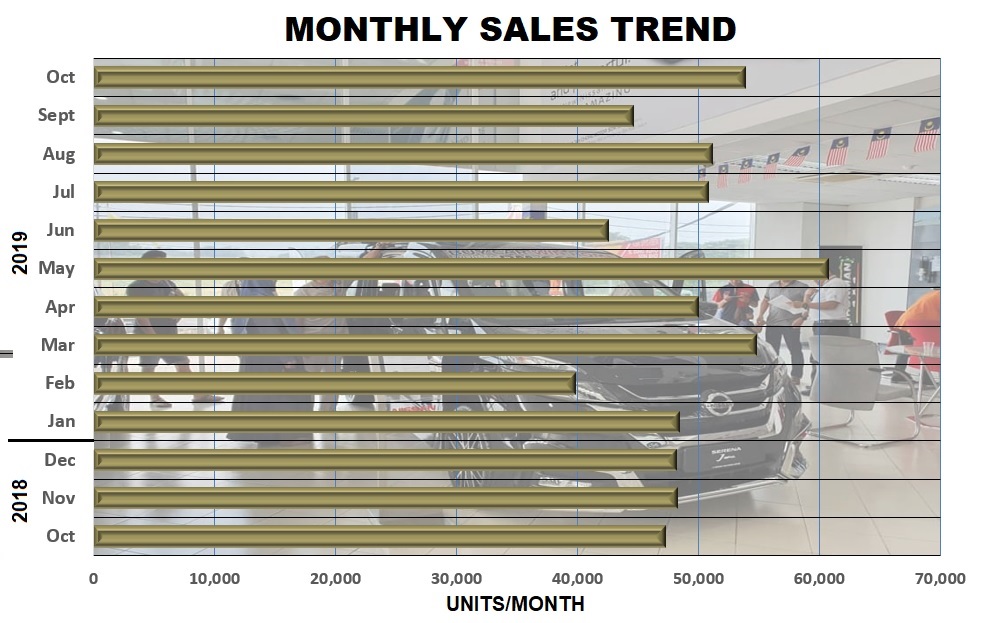

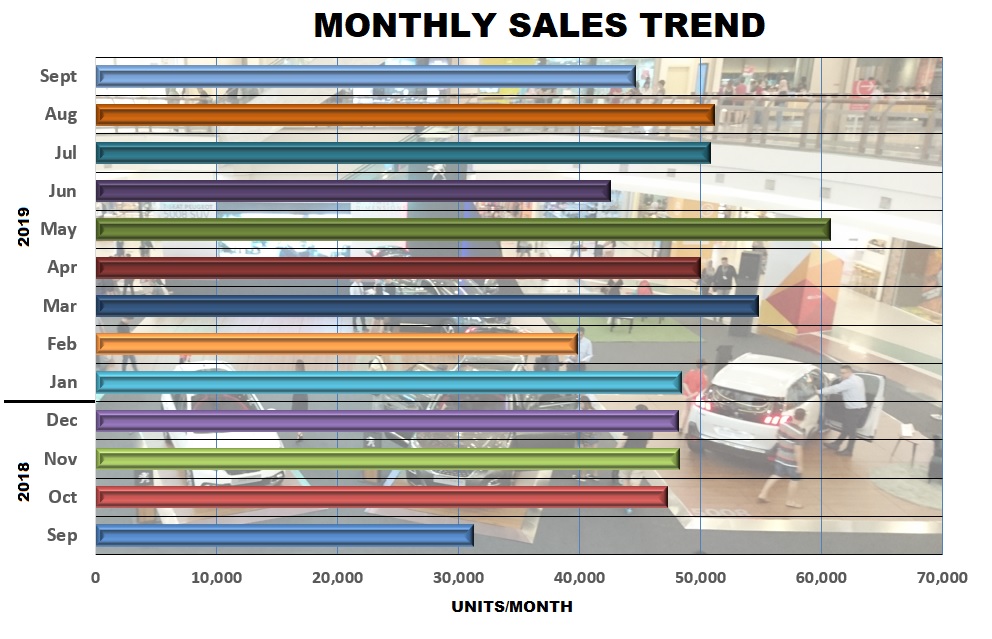

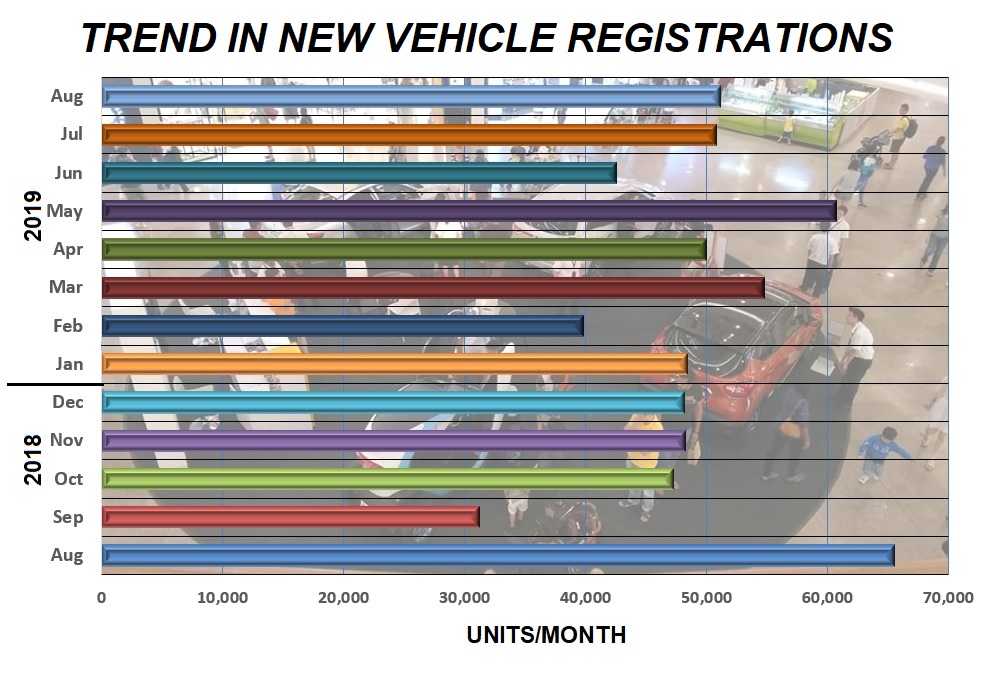

♦ The Total Industry Volume (TIV) in 2019 was 604,287 units, the first time that the volume of sales crossed the 600,000 level since 2015. The achievement was helped by a boost in December with total sales of 54,842 units, the second highest monthly volume in 2019.

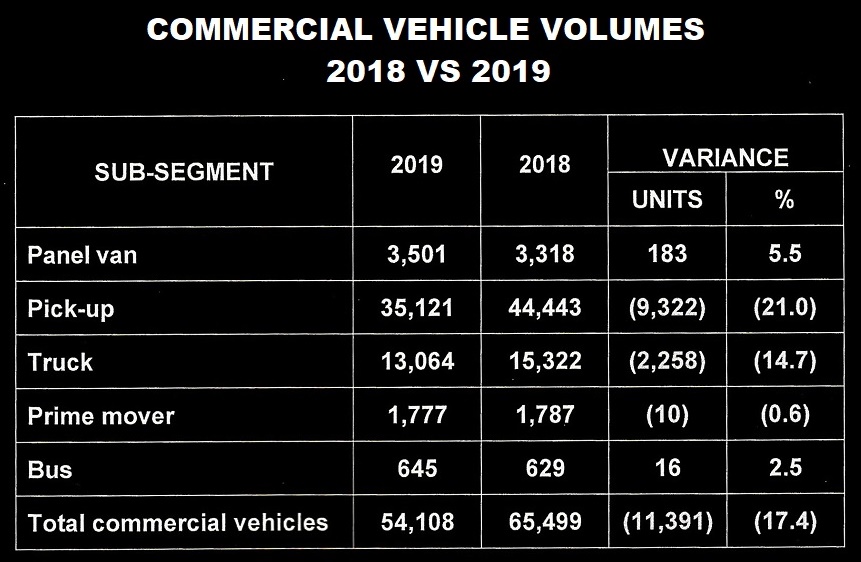

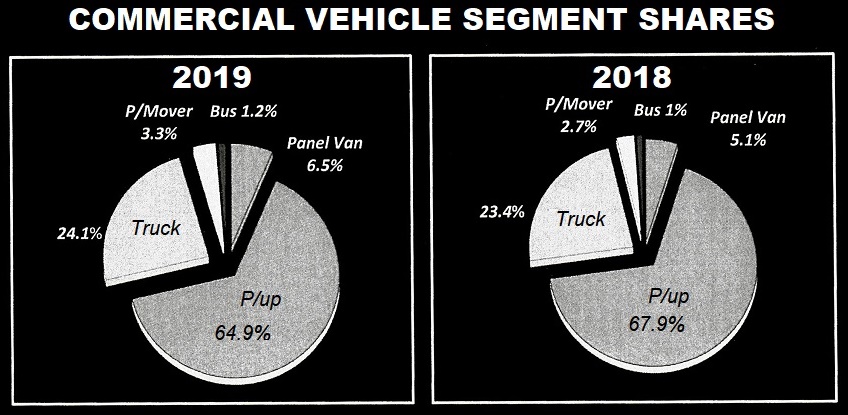

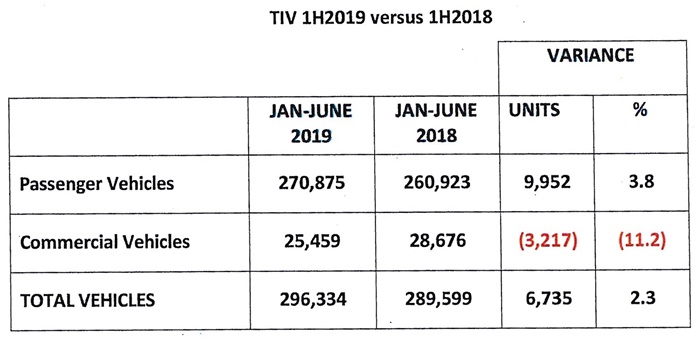

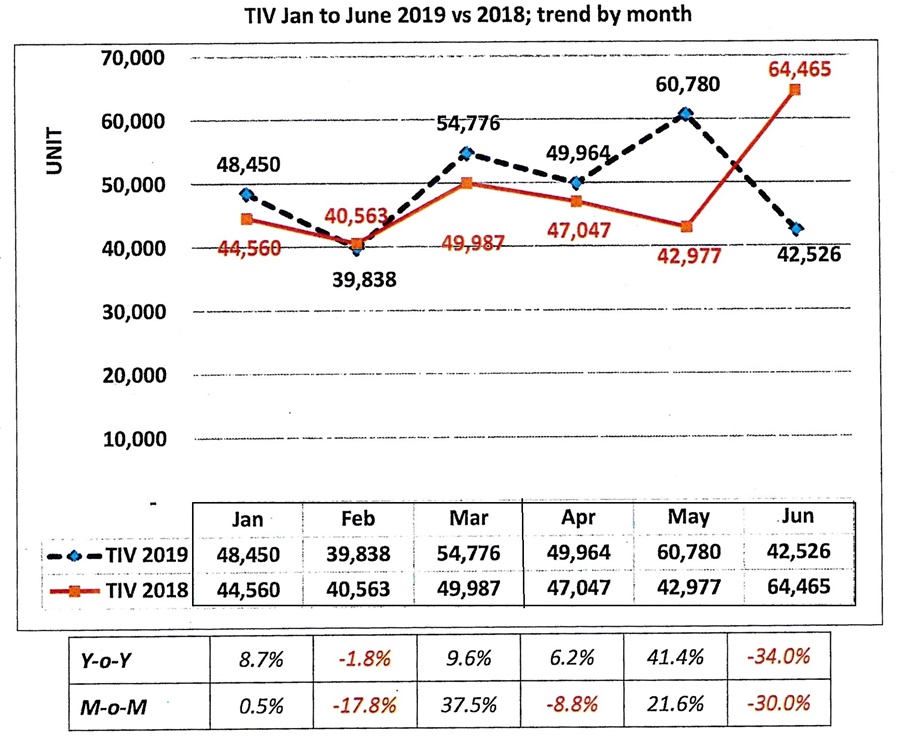

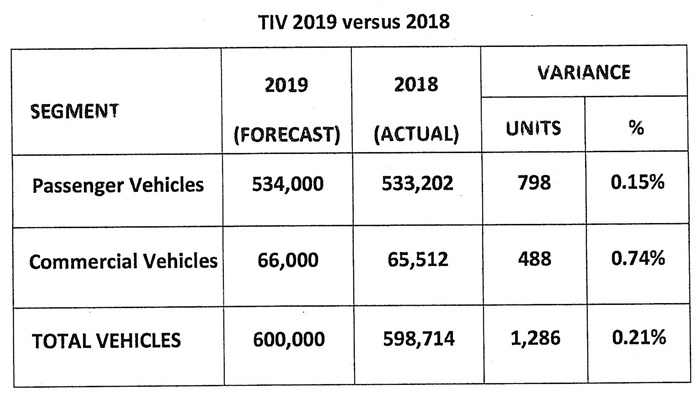

♦ While sales of passenger vehicles rose by 3.2% compared to the year before, the opposite was the case for the commercial vehicle segment (which includes pick-up trucks) as it saw a decline of 17.4%. The uncertainty of the fate of major projects in the first half of the year as well as a general slowdown of the economy had companies holding back on capital expenditures.

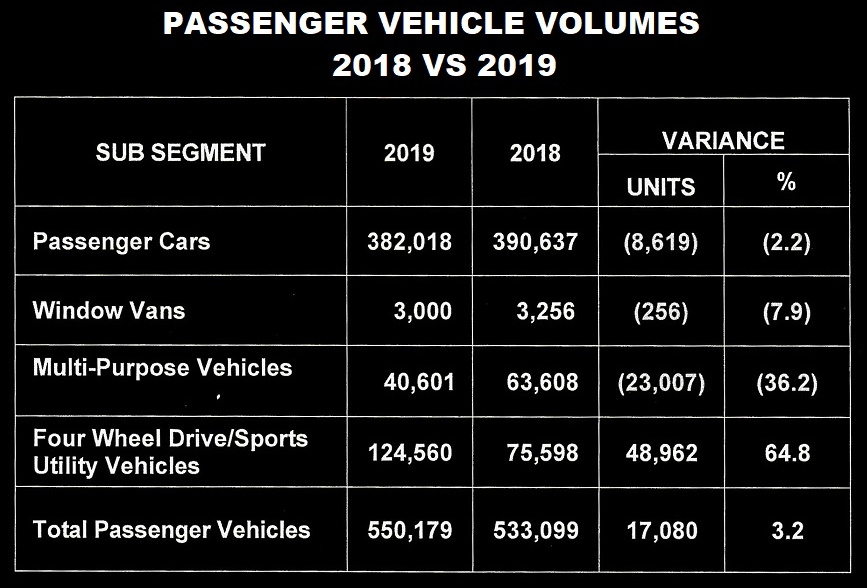

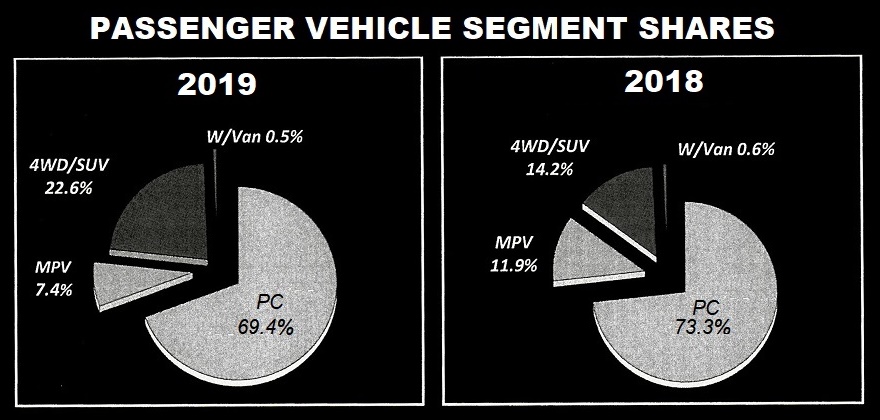

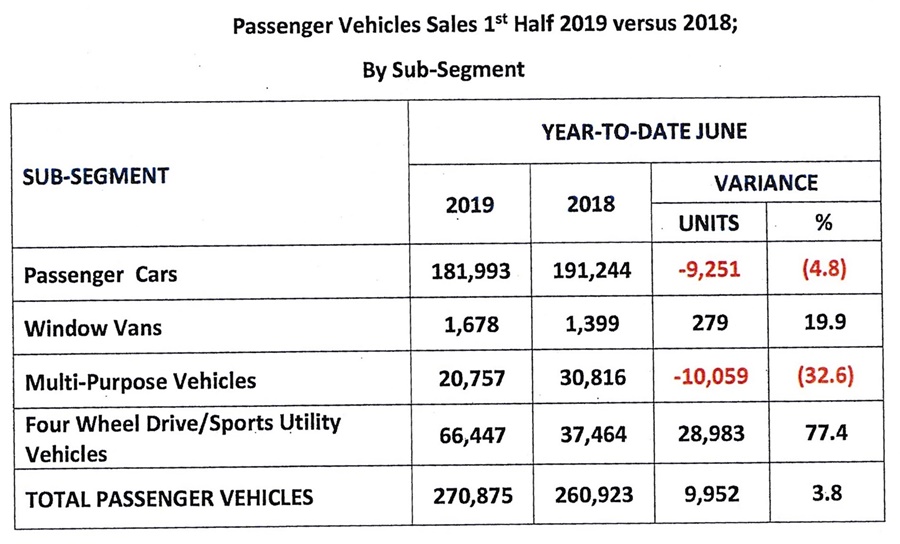

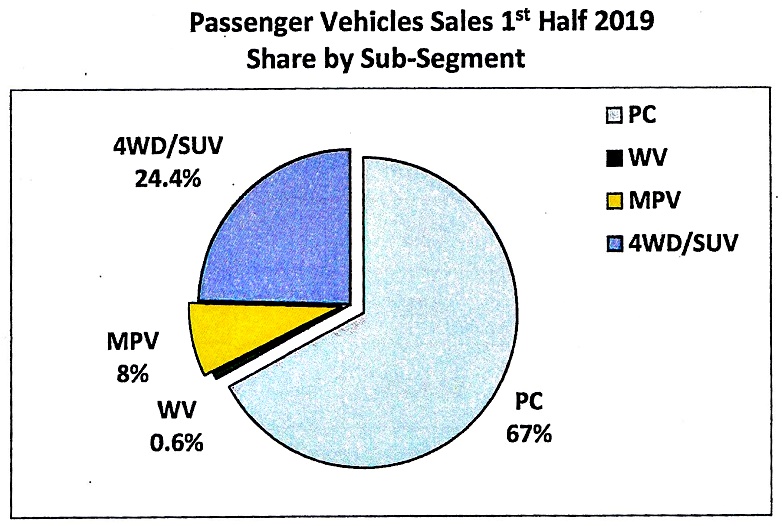

♦ Sales of 4WDs and SUVs grew noticeably (8.4%) at the expense of passenger car and MPV segments, the former contracting by 3.9% and the latter by 4.5%. Nevertheless, passenger cars (sedans and hatchbacks) still accounted for the largest share of passenger vehicle sales (69.4%), while 4WDs/SUVs had a 22.6% share.

♦ Sales of pick-ups, once a popular segment, fell significantly from 44,443 units in 2018 to 35,121 units in 2019, a reduction of 21%. Nevertheless, these vehicles – which are used for personal transport as well as for business purposes – accounted for almost 65% of commercial vehicle sales.

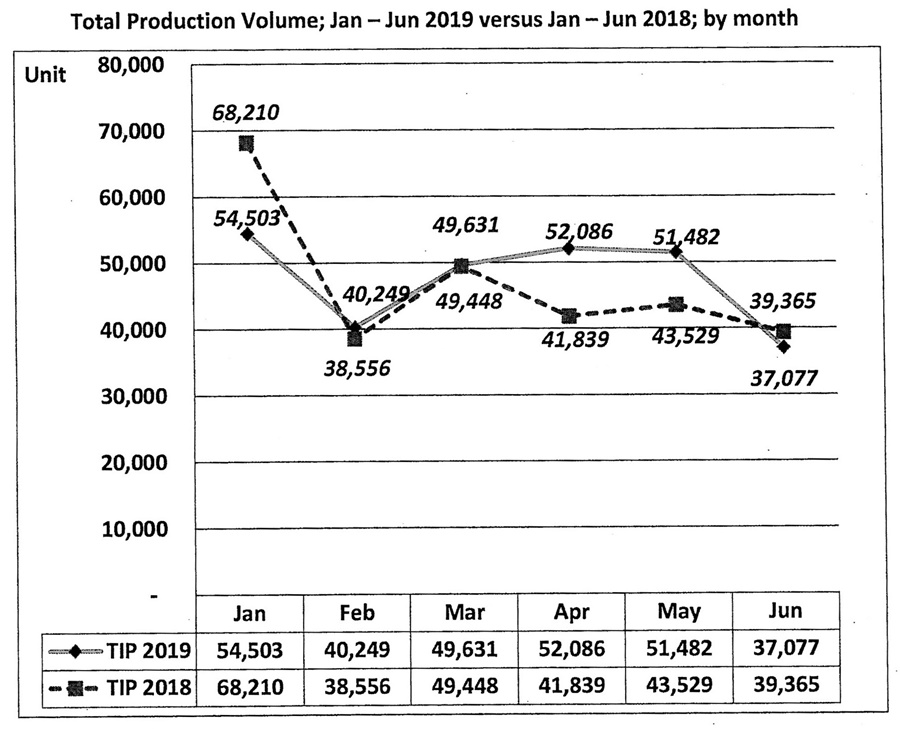

♦ Local production of vehicles totaled 571,632 units in 2019, a modest 1.2% increase over the output in 2018. While more passenger vehicles were produced (+2.6%), the plants cut back on production of commercial vehicles by 15.6% in the light of uncertain demand.

From 2020 to 2024

♦ Looking ahead, the Malaysian Automotive Association (MAA) does not expect the market to grow substantially in 2020 and has forecast a TIV of 607,000 units, just 0.5% more than the 2019 figure. As in the past, this will be reviewed after the first 6 months of sales.

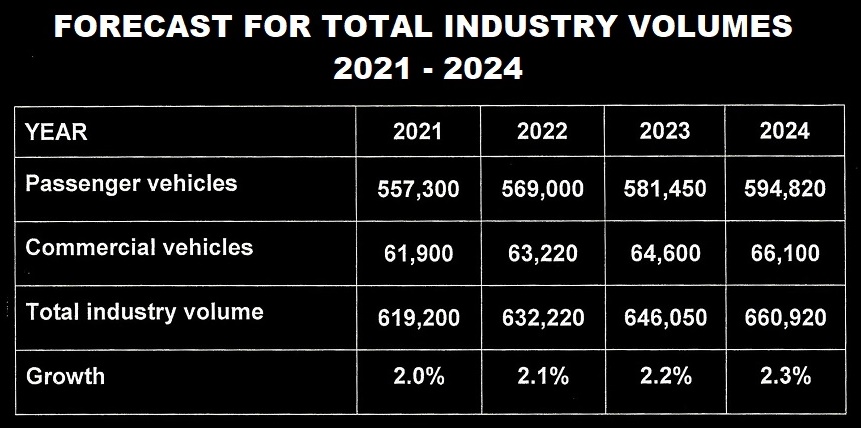

♦ Looking further ahead for the period from 2021 to 2024, the MAA sees the market improving a bit and forecasts annual TIV growth of 2% to 2.3%, reaching 660,920 units by the end of 2024. With sales in Indonesia and Thailand currently around 300,000 units greater, Malaysia will remain at No.3 position in ASEAN.