While Proton has continued to buck the local industry trend with steady growth in 2020, its export activities have also seen some momentum upwards. This is in spite of the extremely challenging conditions brought on by the COVID-19 pandemic that have impacted the auto industry. The carmaker’s exports have grown 10.6% so far this year and it is looking forward to selling even more vehicles outside Malaysia in 2021.

An unprecedented launch schedule has been planned with as many as 5 market introductions to take place in the coming weeks. One of these events will be the export market debut of the Proton X50 in Brunei, and another two will see the start of local assembly and sales of Proton vehicles in Kenya.

“While local market leadership is one of our targets, it is equally vital for the Proton brand to build up its presence internationally, representing both the company and Malaysia. This was part of the 10-year plan that was devised at the beginning of our strategic partnership with Geely,” said Dato’ Sri Syed Faisal Albar, Chairman of Proton Holdings Berhad.

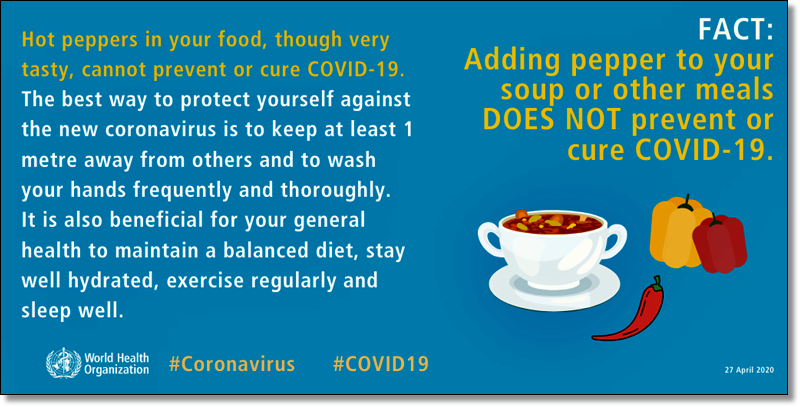

“However, parts of the export plans were affected by the COVID-19 pandemic as each country had different responses and restrictions. Still, thanks to our diligent work and the strong support of various government agencies, we are finally getting back on track,” he added.

Additionally, Proton importers in Bangladesh and Egypt will also be hosting virtual product launches for the latest Saga before 2020 ends. This will be followed by a similar launch in Nepal just as the year draws to a close.

History of Proton exports

In the early years of Proton’s existence, its focus was on the domestic market which took virtually every car it made. Export markets, though established, were not given great attention and even Mitsubishi Motors, its partner, suggested that it concentrate on developing its skills in making cars and about the business before embarking on overseas sales.

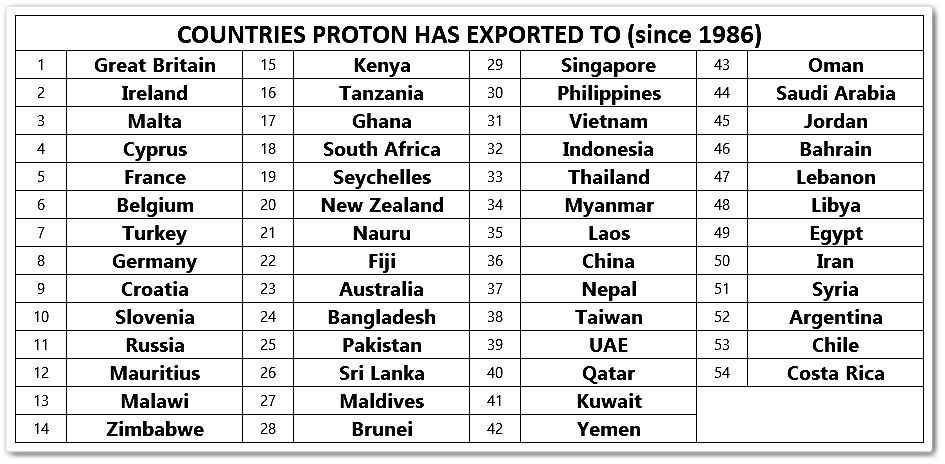

Nevertheless, Proton began exporting just one year after the first Saga went on sale in Malaysia. Its early targets were those which were ex-British colonies, like Malaysia, and where traffic went on the left side of the road like us. This would make it unnecessary to develop a lefthand drive variant so soon.

The UK market was considered a market with great potential then, and it was hoped that the Malaysian origins of the Saga would appeal to the British who had lived in Malaysia in the pre-Merdeka period. The first model was introduced at the Birmingham Motorshow in 1988 and initially, Proton received some preferential taxation as it was a small volume brand entering the market. This allowed it to sell at attractive prices and it was well received. The growth in sales in the UK led to a subsidiary being established to handle import and marketing activities, and that market was at one stage, Proton’s biggest export market.

As the only Muslim country in the world to develop its own car and have an automotive brand, Protons from Malaysia were expected to be popular in other Muslim countries. In fact, the first export market was Bangladesh where the Saga first went on sale in 1986. Egypt has also been a strong market for Proton since it entered in 2004.

By 2001, Proton had appeared in over 50 countries around the world, some in significant numbers and some just a handful. It had tried to enter the US market in the late 1980s, appointing a business partner called Global Motors which created a unit known as ‘Proton America’ to get the necessary approvals. Two units of the Saga modified to lefthand drive and with 1.8-litre engines were sent to a motorshow in Las Vegas in 1988 in what was meant to be a prelude to exporting the first batch of 30,000 cars to the USA for sale. However, things didn’t work out as expected and no further attempts were made to enter the biggest car market in the world at that time.

Like many manufacturers, Proton also considered local assembly in some markets and it did so for a while in the Philippines and had a project going for Iran. It also had a joint venture company with Mitsubishi Motors in Vietnam and the deal was that for models above 1600 cc, Mitsubishi’s models would be used, and Proton would provide models below 1600 cc. But things didn’t proceed as planned and Proton never got to assemble any model.

From 2001 onwards, Proton had a new range of models and hoped to grow its exports, especially as the domestic market was supposed to be ‘opening up’ and competition would become more challenging. It even built a new factory in Tanjung Malim, Perak, with a capacity of up to 500,000 units in anticipation of an export offensive regionally.

However, for various reasons, export activities diminished and in Europe, as the emission and safety regulations got tougher, Proton’s aging platforms and engines became unacceptable. By 2010, even the ‘father of Proton’, Tun Mahathir Mohamed, acknowledged that perhaps Proton had not given sufficient thought to the need to make its cars suitable for global markets and only focussed on the domestic market because it was big enough. Dealerships in many of the 50 markets slowly stopped selling Proton which was not so helpful at a time when the company was also facing a decline in domestic sales.

The low export volumes since 1986 – around 406,000 units in total – are obviously not acceptable and exports are vital if the carmaker is to grow further. While being a significant global player would be too ambitious and unrealistic, the aim is to become No. 3 in ASEAN besides becoming No. 1 in Malaysia in due course.

“We are exploring all opportunities to grow export volumes for Proton,” said Dr Li Chunrong, CEO of Proton. “We are also leveraging on Geely’s extensive overseas network operations to increase the cost-effectiveness of Proton’s operations. Geely can support us in these initiatives and there is a lot of experience within the Group so we hope to leverage on it to enable us to sell more cars outside of Malaysia.”

Click here for other news and articles about Proton.