Touch ‘n Go Group has launched ParkInsure, a unique insurance/takaful product for users who utilise the Touch ‘n Go card for parking. For just RM5 per month, users can access this coverage seamlessly through the GOprotect digital hub on the Touch ‘n Go eWallet platform.

They can choose between takaful from Zurich General Takaful Malaysia Berhad or conventional insurance from Allianz Malaysia Berhad. This offering provides affordable coverage for personal accidents, enhancing the convenience and security of Touch ‘n Go transactions.

ParkInsure comes with several helpful benefits:

- Accidental Death or Disablement Coverage: If an accident happens within the car park compound leading to permanent disablement or accidental death, users can get reimbursed up to RM70,000.

- Snatch Theft Inconvenience Benefit: In case of snatch theft within the car park area, users can receive up to RM1,500 to cover inconveniences.

- Forcible Car Break-Ins: If a car break-in occurs in the car park, users are eligible for reimbursement up to RM1,500.

- Key Reimbursement: If a user’s car key is stolen or damaged during coverage, a reimbursement fee of up to RM200 is provided.

These benefits provide protection and support for various situations that might happen in the car park, making ParkInsure a helpful addition for Touch ‘n Go card users.

In the conventional plan, users get extra benefits like up to RM200 for transportation charges to the hospital due to a car park accident and RM10 if their enhanced Touch ‘n Go card is lost to snatch theft in the car park.

For the takaful plan, users receive a different benefit. They can get up to RM200 for inconveniences if their car is damaged in a car park accident. These additional benefits are meant to provide more support and convenience for users in different situations while using their Touch ‘n Go cards for parking.

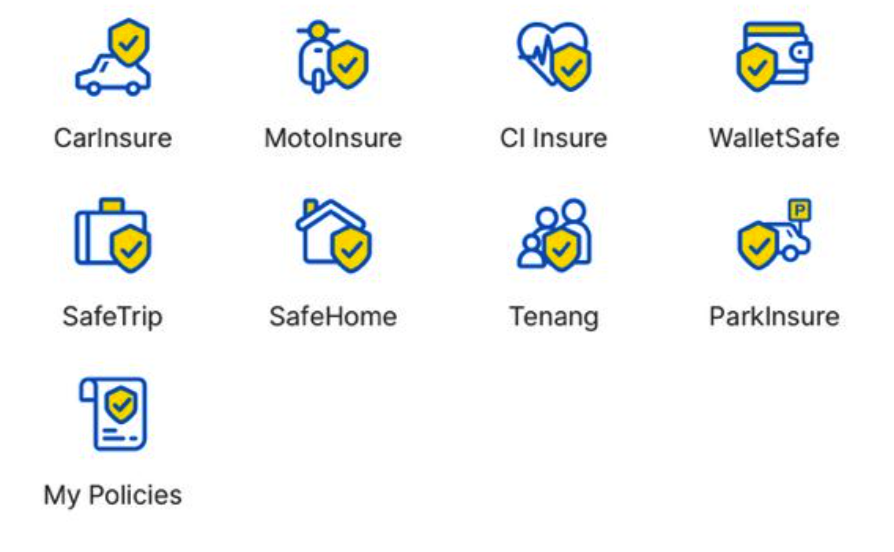

Touch ‘n Go eWallet users can subscribe to the ParkInsure insurance/takaful plan in under 3 minutes using GOprotect. They have the choice between takaful and conventional plans. The process ensures hassle-free claims through the insurers’ 24/7 claim hotline. Additionally, users can conveniently manage and access their policies/certificates through the “My Policies” tab on their eWallet app, streamlining their experience.