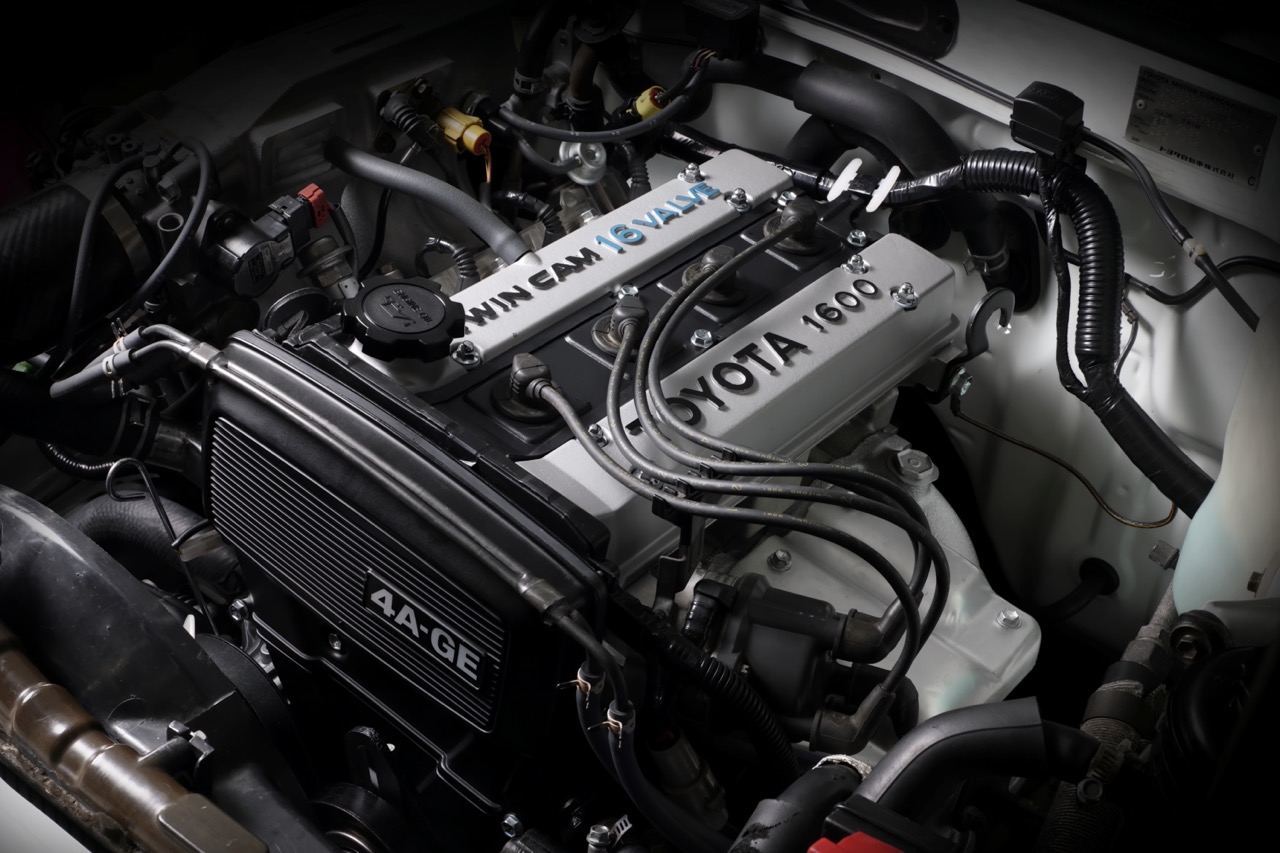

Proton dan Touch ‘n Go Sdn. Bhd. mengumumkan kerjasama strategik untuk mengintegrasikan teknologi RFID Touch ‘n Go ke dalam Proton X50 serba baharu. Kerjasama ini, yang dimeterai melalui Memorandum Persefahaman (MoU), menandakan satu pencapaian penting dalam memacu ekosistem mobiliti terhubung di Malaysia.

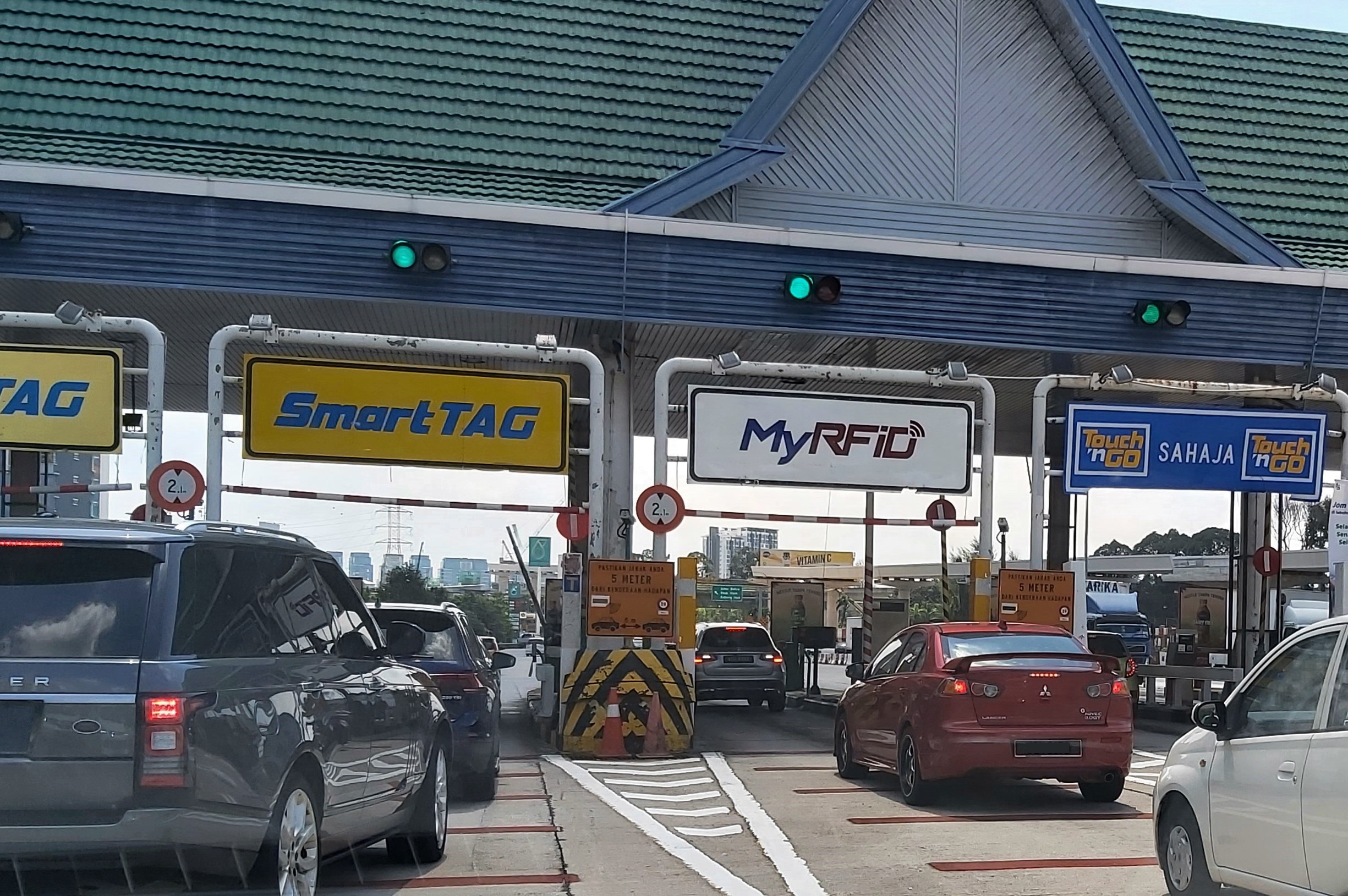

Di bawah perjanjian ini, setiap Proton X50 baharu akan dilengkapi dengan tag RFID Touch ‘n Go terus di barisan pengeluaran, membolehkan akses lancar ke rangkaian lebuh raya berteknologi RFID di seluruh Malaysia. Inisiatif ini mencerminkan komitmen kedua-dua syarikat untuk menyediakan pengalaman pemanduan yang lebih pintar dan mudah bagi pengguna di Malaysia.

Majlis menandatangani perjanjian ini berlangsung di ibu pejabat Proton Centre of Excellence di Shah Alam. Penandatangan bagi pihak MoU ini ialah Praba Sangarajoo, Ketua Pegawai Eksekutif Touch ‘n Go, dan Zhang Qiang, Timbalan Ketua Pegawai Eksekutif Proton Edar, manakala saksi bagi perjanjian ini ialah Jarrod Wong, Pengarah Jualan Touch ‘n Go, serta Ong Chee Wooi, Ketua Jualan Proton Edar.

“Ini tentang kepuasan segera,” kata Praba Sangarajoo, Ketua Pegawai Eksekutif Touch ‘n Go Sdn. Bhd. “Anda memandu keluar Proton X50 baharu dari bilik pameran dengan RFID yang sudah siap dipasang — begitu sahaja. Ini bukan sekadar mengenai mobiliti pintar; ia mengenai membawa nilai sebenar dan keseronokan ke dalam perjalanan harian.”