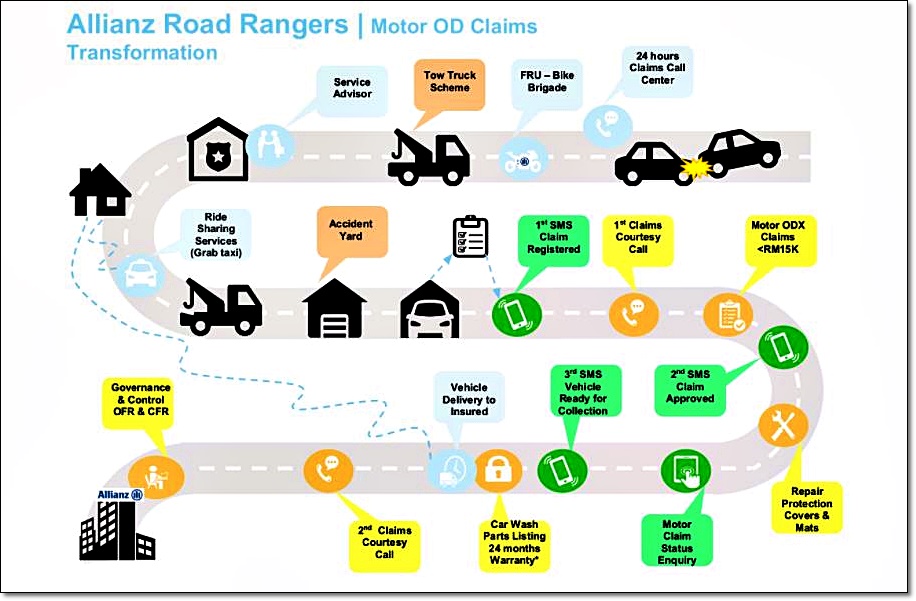

When Allianz General Insurance Company (Malaysia) Berhad introduced its Allianz Road Rangers service in 2017, it was industry first. It has certainly been a much appreciated service by motorists (64,000 of them in 2021, according to the company). Besides having their own Allianz-branded tow trucks, the team also has a first-responder bike team to reach motorists faster. They can provide initial assistance and first aid, if needed.

Furthermore, the company provides complete support to its policyholders after their accident. They are assisted in making police reports, submitting claims and kept informed of the progress of their vehicle’s repairs if it has been sent to an approved workshop.

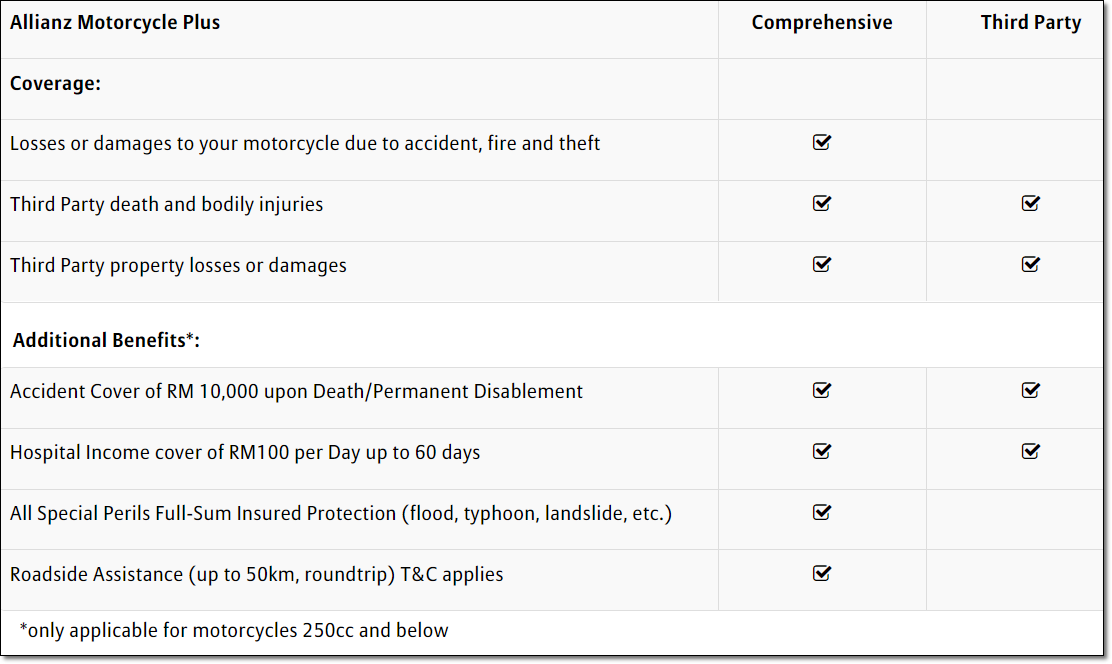

In September last year, the company also extended the free roadside assistance to its policyholders who take comprehensive coverage for their motorcycles (below 250 cc).

“As an insurer, we should be there for our customers. It is as simple as that. While many others have shunned away from such a service simply for not being financially lucrative, sometimes, there is no harm in giving a little more. This is our way of saying thank you to our customers and letting them know that we are here for them in times of need,” said Allianz General’s CEO, Sean Wang.

Hybrid trucks can take 2 vehicles simultaneously

Recently, the company added 5 hybrid trucks to its Allianz Road Rangers fleet, bring the fleet total to 250 tow trucks. The tow trucks are of various types to suit different vehicles. The hybrid truck comes with the combined features of a flatbed carrier and a spectacle lift that can transport 2 accident vehicles simultaneously.

A flatbed carrier features a long hydraulic flatbed that inclines and allows vehicles to be driven or pulled onto the bed for towing, while a spectacle lift or wheel lift tow truck has a metal yoke that hooks up the drive wheels of the vehicle towed. Besides that, the hybrid trucks also carry mini and normal-sized wheel dollies. Furthermore, hybrid trucks can also tow modified or lowered vehicles or vehicles (particularly of continental makes) that may have broken air suspension systems.

Service enhancement

“Since its launch in 2017, the Allianz Road Ranger accident assistance service has been key for our customers. In looking out for our customers, we continue to enhance the service or our fleet to ensure our service remains first-rate. With the addition of the innovative hybrid trucks, we can serve our customers better, more so should two vehicles insured under Allianz General be involved in an accident,” said Allianz General’s Chief of Claims, Damian Williams.

“With the hybrid trucks, our Allianz Road Rangers technicians are also better equipped to handle complicated towing jobs. So, if a flatbed is required and dispatched to the accident scene, but the parking brake is stuck, the technician can easily deploy wheel dollies and tow the vehicle using the yoke, all with no further delay in service,” added Mr. Williams.

MIB (not Men in Black) can provide compensation when you get hit by an uninsured vehicle