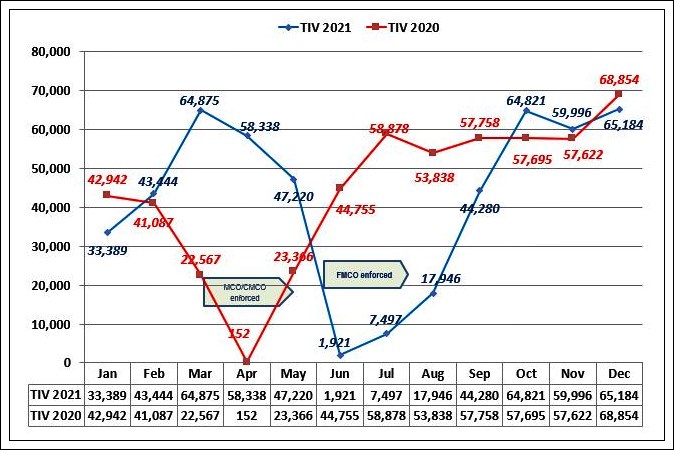

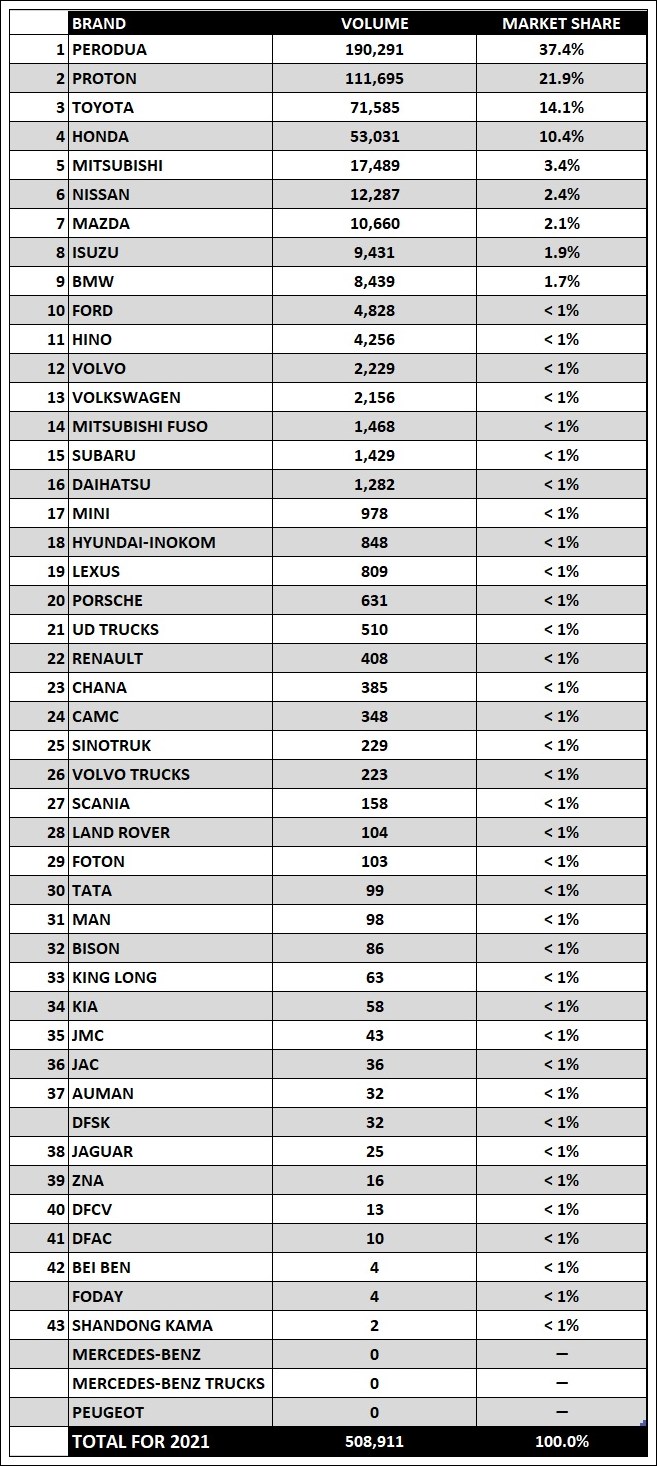

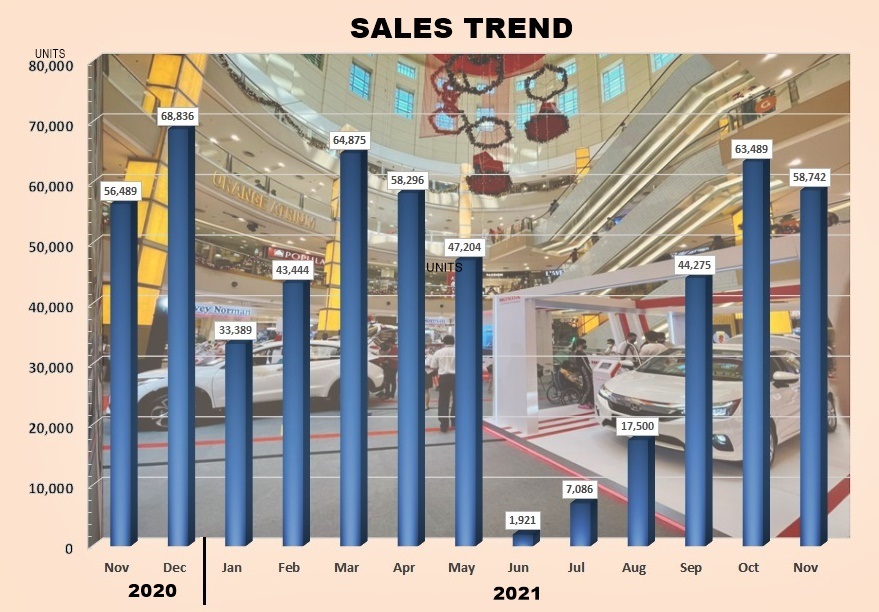

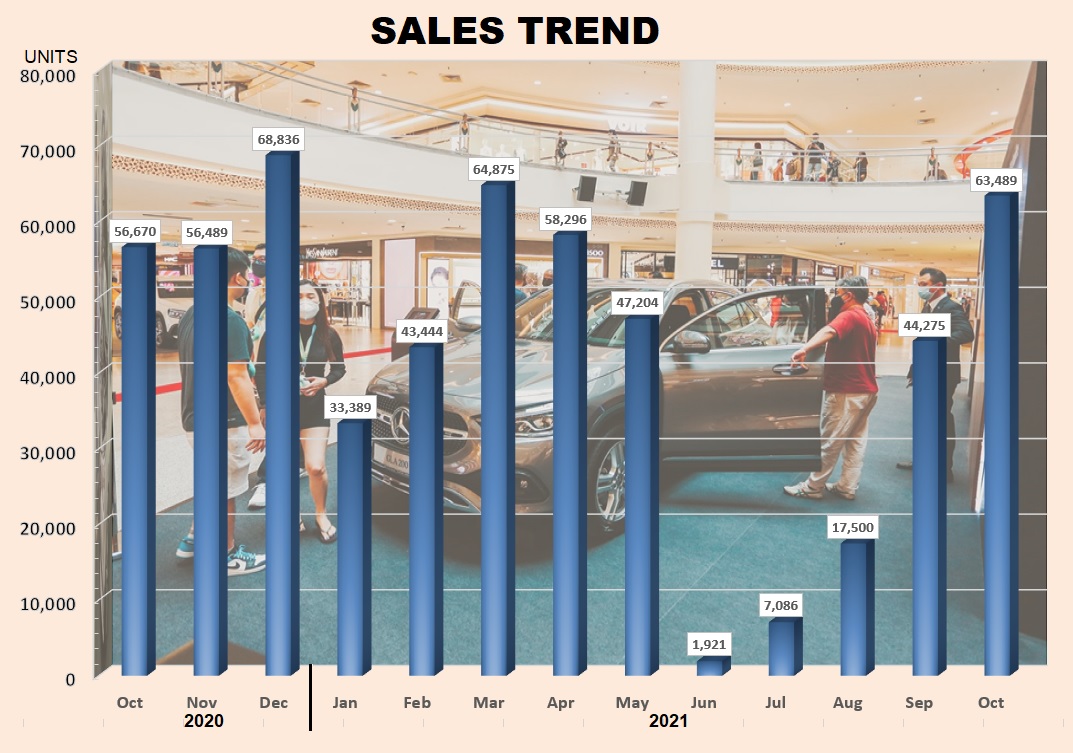

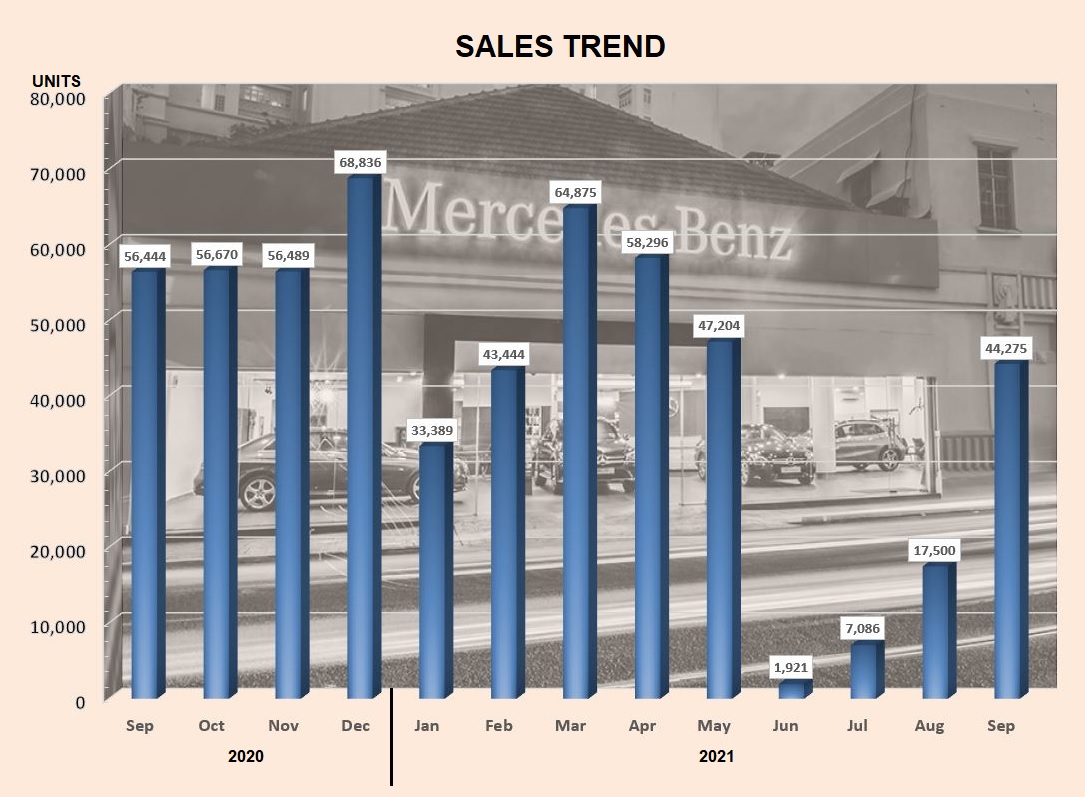

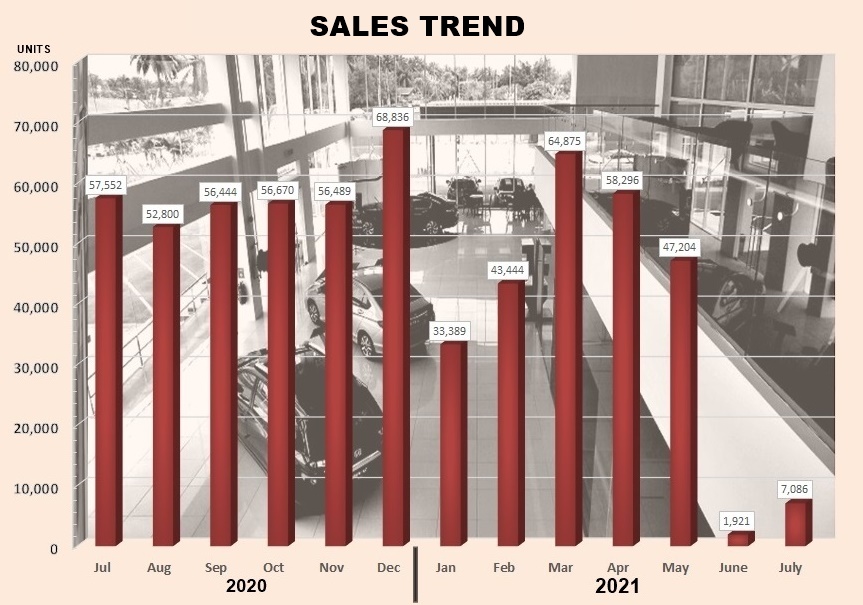

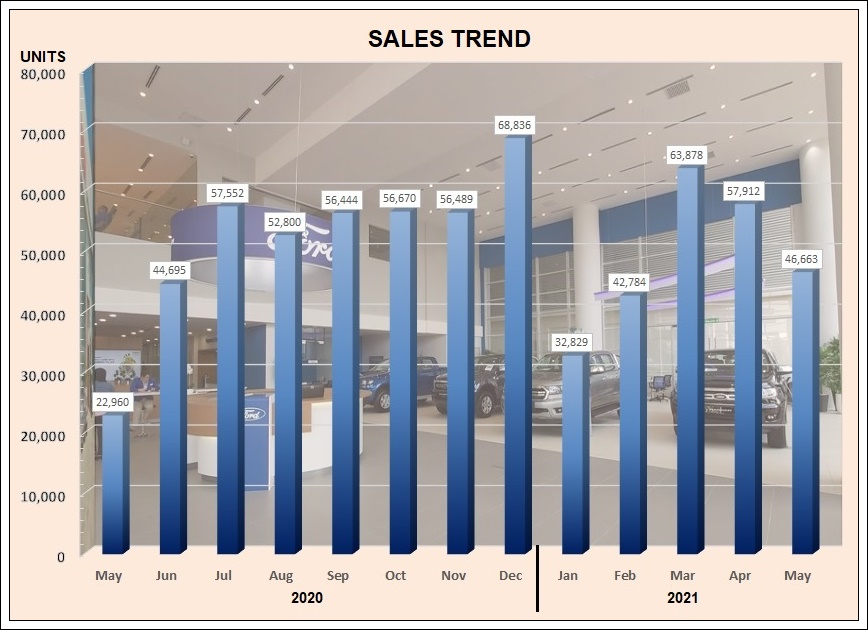

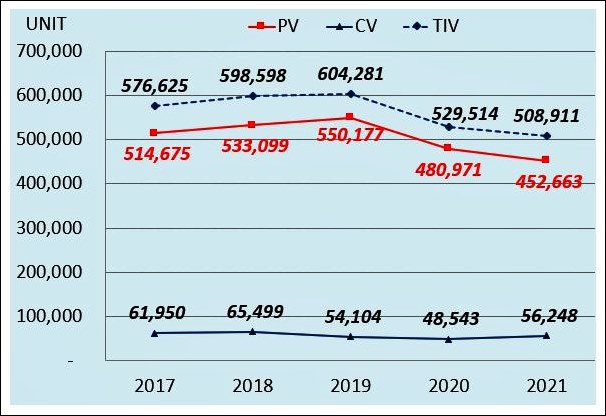

Although 2021 was the second year of the COVID-19 pandemic and the auto industry had been hoping to recover from the impact of the lockdown in 2020, the total number of new vehicles sold was actually lower. Where the Total Industry Volume (TIV) in 2020 was 529,514 units, the TIV for 2021 was 4% lower at 508,911 units.

Nevertheless, the usual final-month push by car companies saw the December having the highest sales volume of the year with 65,184 vehicles delivered nationwide. This contributed to the year’s TIV going past the 500,000-unit level that had been forecast by the Malaysian Automotive Association. While 2021, like 2020, had long periods when business activities – including motor vehicle sales and production – were suspended, the rate of recovery in 2021 was not as quick as the year before.

Commenting on the sales figures, MAA President Datuk Aishah Ahmad said that the measures taken by the government were important factors. “The much smaller TIV’s contraction recorded in 2021 [compared to 2020] can be attributed to the measures and wisdom of our government in balancing between saving lives and jobs so as not to jeopardize the domestic economy,” she said.

Owing to the relaxation of the movement control orders, many economic sectors were allowed to re-open for businesses. This helped to improve business confidence which contributed to more sales of new vehicles, including commercial vehicles which are much needed for the running of businesses. Having deferred purchases during 2020, many companies would have made their fleet purchases during 2021 to support their business activities.

“The extension of the sales tax exemption incentive under PEMERKASA+ package till December 31, 2021, also helped to sustain the demand for new passenger vehicles,” added Datuk Aishah. “Under the PEMERKASA+ package, the government agreed to exempt sales tax up to 100% for completely knocked down (CKD) passenger vehicles assembled in Malaysia, and 50% on passenger vehicles that were imported in completely built-up (CBU) form.

In the passenger vehicle segment, it was evident that even more buyers preferred SUVs, mirroring the global trend which has had manufacturers hurriedly launching new SUV models. In the case of Malaysia, passenger car sales declined by about 19.7% while SUVs grew by 43%. The other segments – MPVs (which used to be second to passenger cars) and window vans – also saw lower sales although not significantly different from their 2020 volumes.

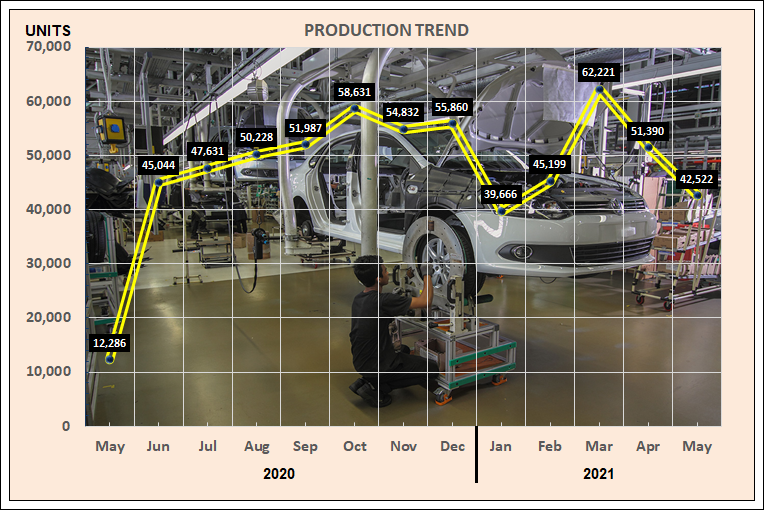

Overall, passenger vehicle sales fell by 5.9% to 452,663 units but this was not entirely due to reduced demand. Some companies also experienced stock shortages due to the semiconductor microchip supply issues which affected their local production or production at overseas factories from which they import their vehicles. It only takes one part being unavailable to prevent a vehicle from being completed and leaving the factory.

The commercial vehicle segment (which includes pick-up trucks)) fared better, recording an increase of 15.9% to a volume of 56,248 units, which represented 11% of the TIV. In this segment, pick-up trucks registered the biggest increase of 20.9% to 40,736 units, account for 72% of the commercial vehicle segment.

The growth would have been helped by the introduction of new models like the Isuzu D-MAX during the year. The all-new generation of the popular pick-up truck was launched in April and Isuzu Malaysia reported that average monthly orders were 100% higher than the previous generation.

The bigger commercial vehicles saw lower sales; bus sales, for example, fell by almost 50% between 2020 and 2021 although this would be understandable in view of the situation. With restrictions on interstate travel for much of last year and borders with Thailand and Singapore pretty much closed, tour companies would not have wanted to get new vehicles. However, truck sales did go up by 5.3%, probably in view of increasing demand for delivery services.

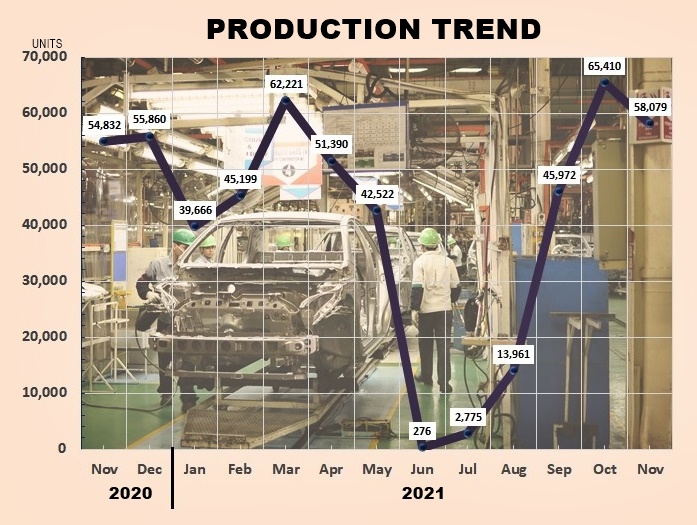

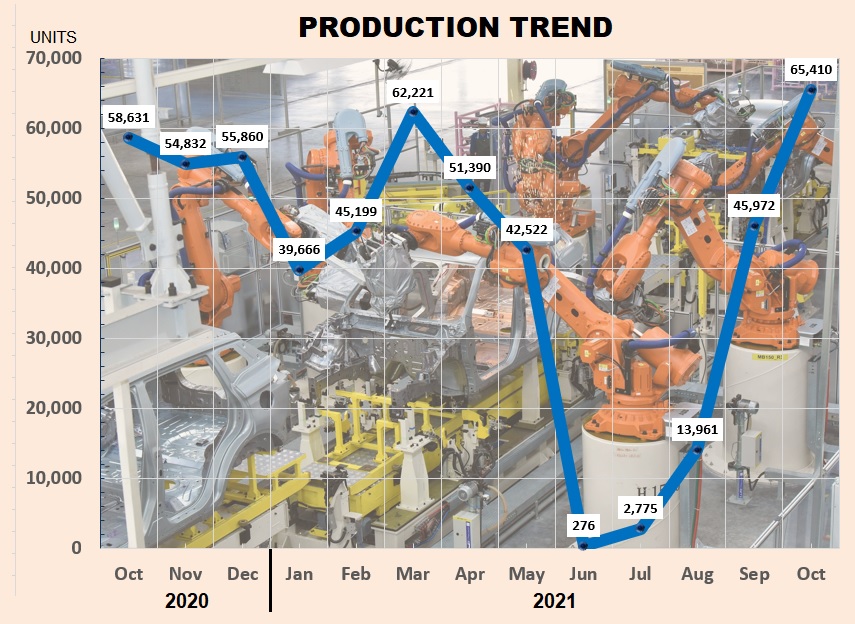

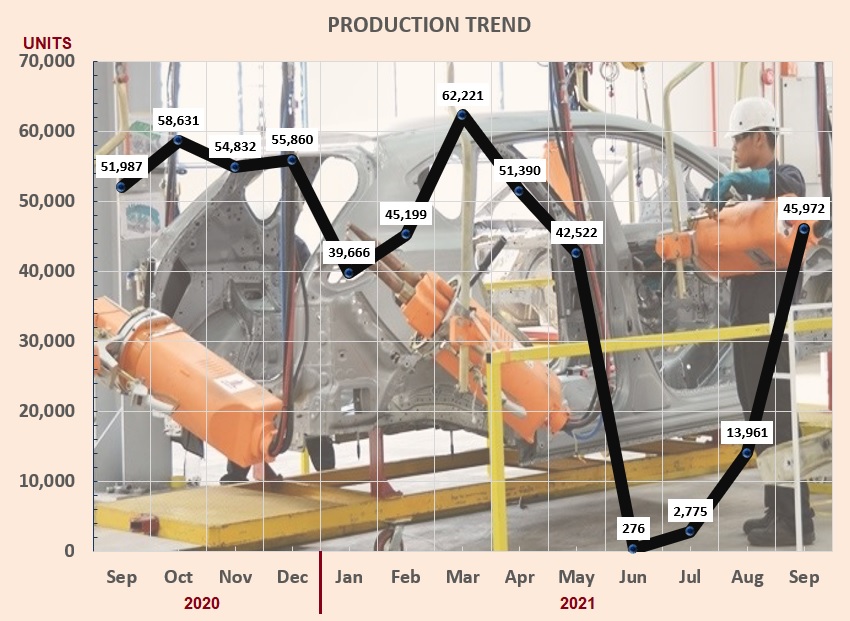

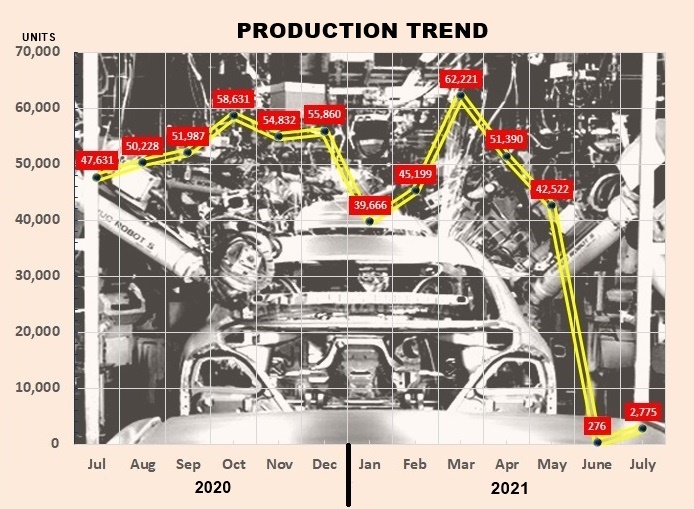

Although the factories were forced to shut down for an extended period, the drop in local production was actually minimal – 3,535 units or 0.7%, compared to 15% in 2020 when the drop from 2019 was almost 87,000 units. While passenger vehicle production declined by 11,324 units (2.5%), commercial vehicle production actually rose by 7,789 units (28.4%). Outputs rose for trucks and panel vans which, as mentioned earlier, had greater demand.

Looking ahead in 2022

Notwithstanding pandemic-related issues that can cause disruptions and supply chain issues such the global shortage of semiconductor chips, rising cost of freight, there are still some positive aspects that can boost new vehicle sales in 2022.

Continuation of the sales tax exemption for imported and locally assembled passenger vehicles till June 30, 2022 will be helpful in encouraging people to buy new vehicles. Bank Negara Malaysia’s decision at its Monetary Policy Committee (MPC) meeting in November 2021 to maintain the benchmark Overnight Policy Rate at 1.75% will provide additional policy stimulus to accelerate the pace of economic recovery. This may help to stimulate domestic spending including for high-cost items like motor vehicles, and with the economic recovery will come more consumer spending.

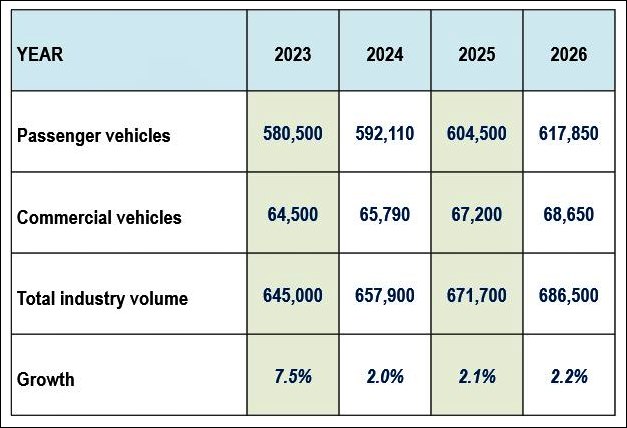

Therefore, the MAA is optimistic that the industry will accelerate its recovery in 2022 and is forecasting growth of 17.9% over the 2021 TIV. This would take the volume to the elusive 600,000 units that has been difficult to reach (the last time was in 2019 when the TIV was 604,281 units). The MAA expects the passenger car segment to grow by 19.3% and account for 540,000 units, with the commercial vehicle segment (which includes pick-up trucks) growing by 6.7% to 60,000 units.

Looking further ahead, the MAA expects 2023 to be a boom year as recovery continues with rising demand after 2022. It forecasts a 7.5% increase to 645,000 units then but then the market will slow down again with average growth of around 2% annually up to 2026. Of course, much depends on how the pandemic runs its course although the government has made it clear that there will not be lockdowns again (apart from targeted ones, if really necessary).