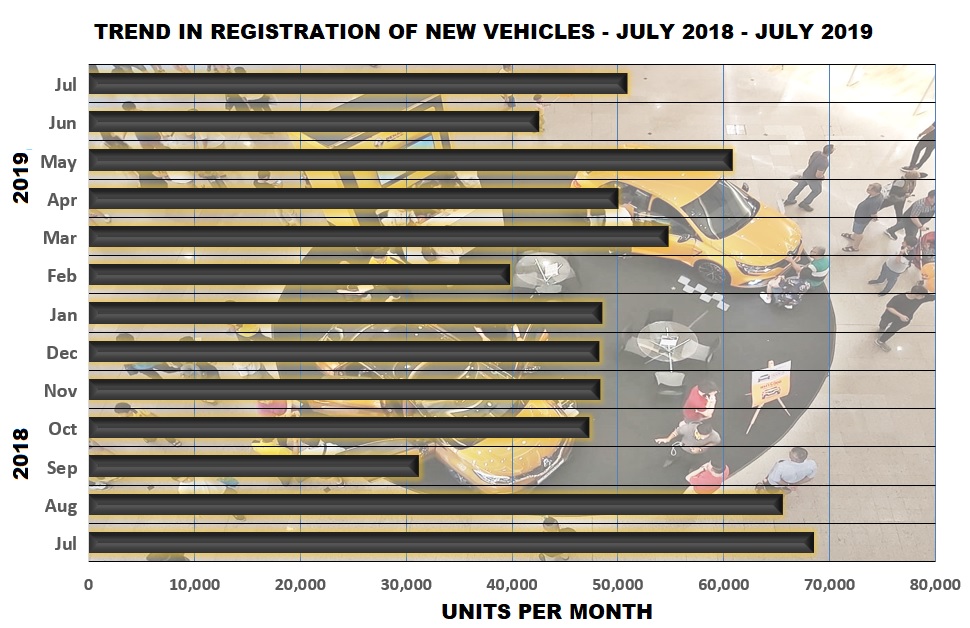

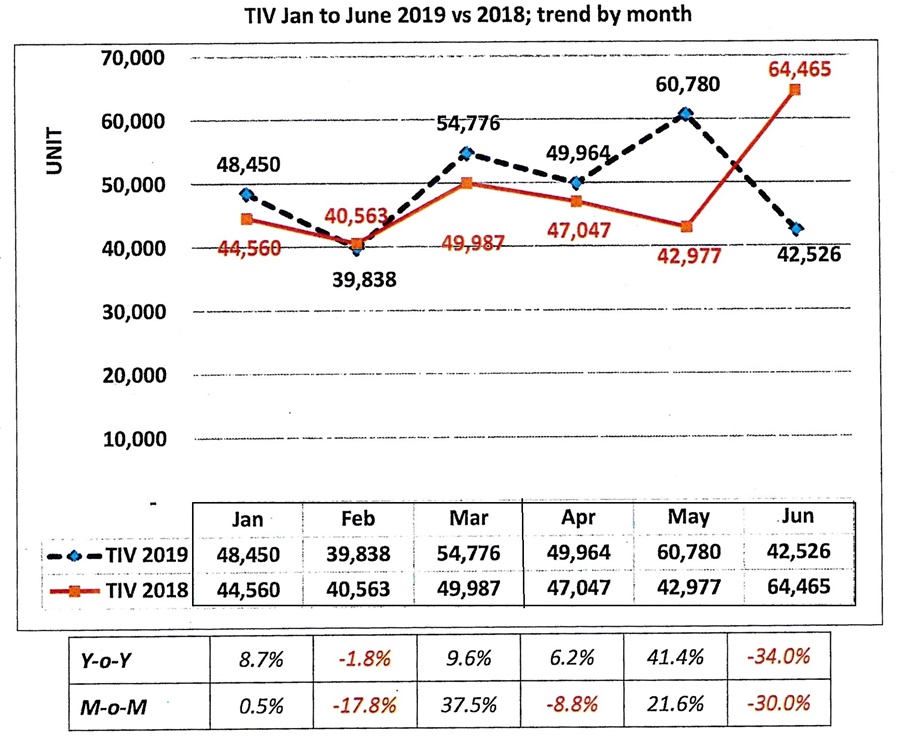

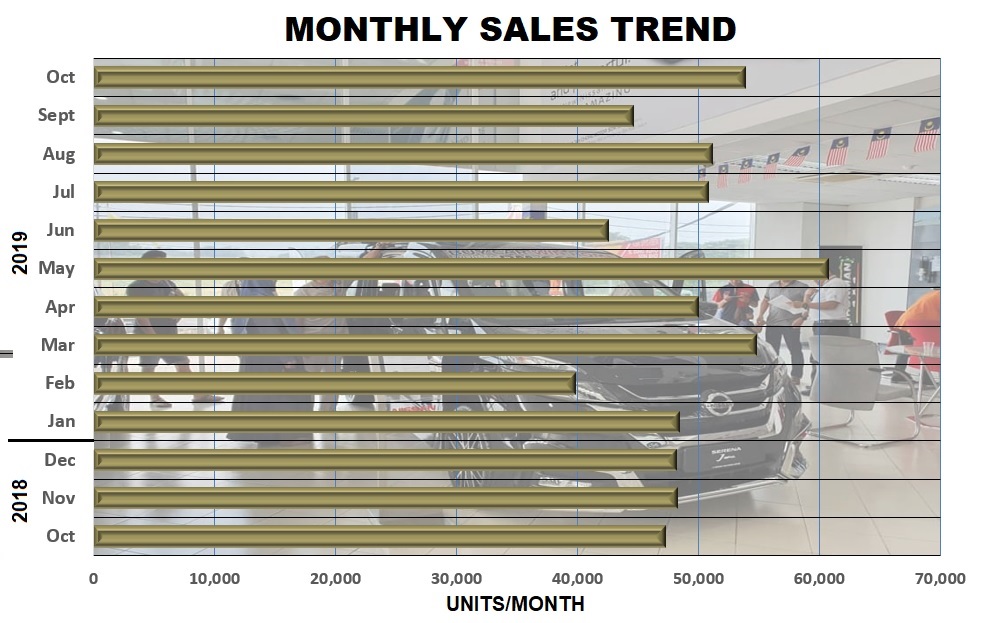

New vehicle sales for October – the first month of the final quarter of 2019 – began on a high note with a 21% increase over the Total Industry Volume (TIV) in September to 53,870 units. This volume was also 14% higher than for the same month in 2018 although a comparison may not be right since it was after the GST-free period when sales had seen a huge boost and the market slowed down in the first few months after that.

The Malaysian Automotive Association (MAA) attributed the increased TIV to more selling days as well as more working days. When there are many holidays, there is also disruption in processes such as registration and loan approvals, delaying completion and affecting deliveries.

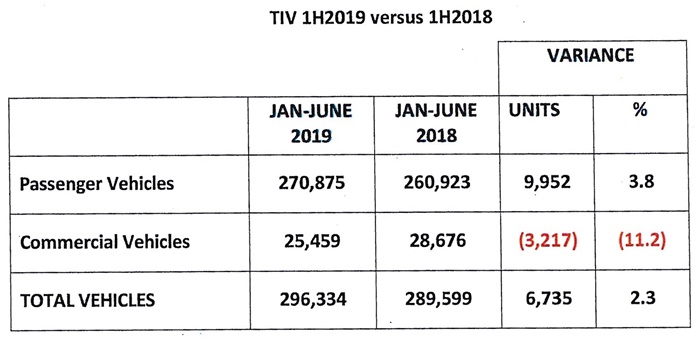

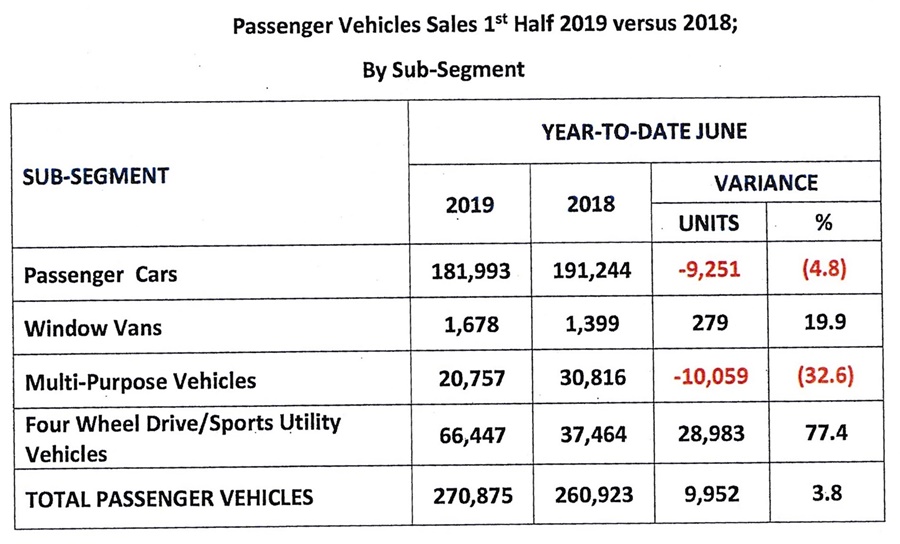

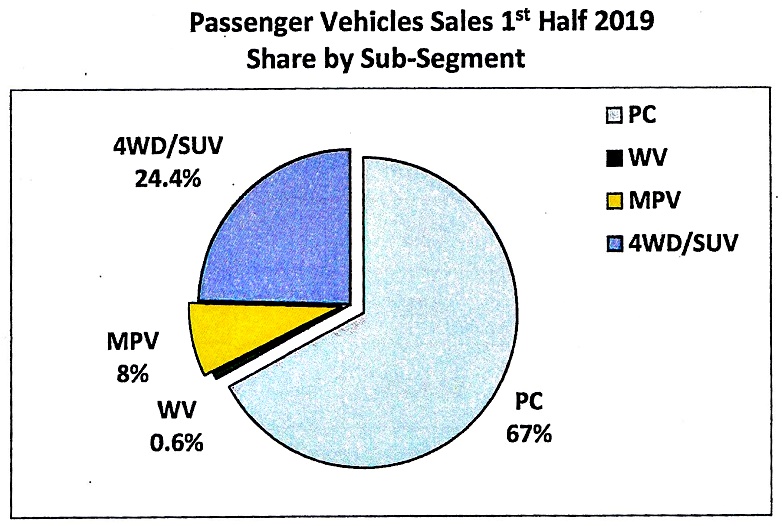

By segment, passenger vehicles (excluding pick-up trucks for personal use) accounted for 93% of the TIV in October, a 16% increase over the same month in 2018. However, commercial vehicle sales were virtually unchanged with 4,883 units (including pick-up trucks) delivered.

The cumulative TIV after 10 months of this year reached 496,861 units which was 5,267 units lower than for the same period in 2018. The higher TIV last year was due to the 3-month GST-free period which saw an above-average surge in monthly sales as buyers could enjoy significant savings (especially for the more expensive models).

Production

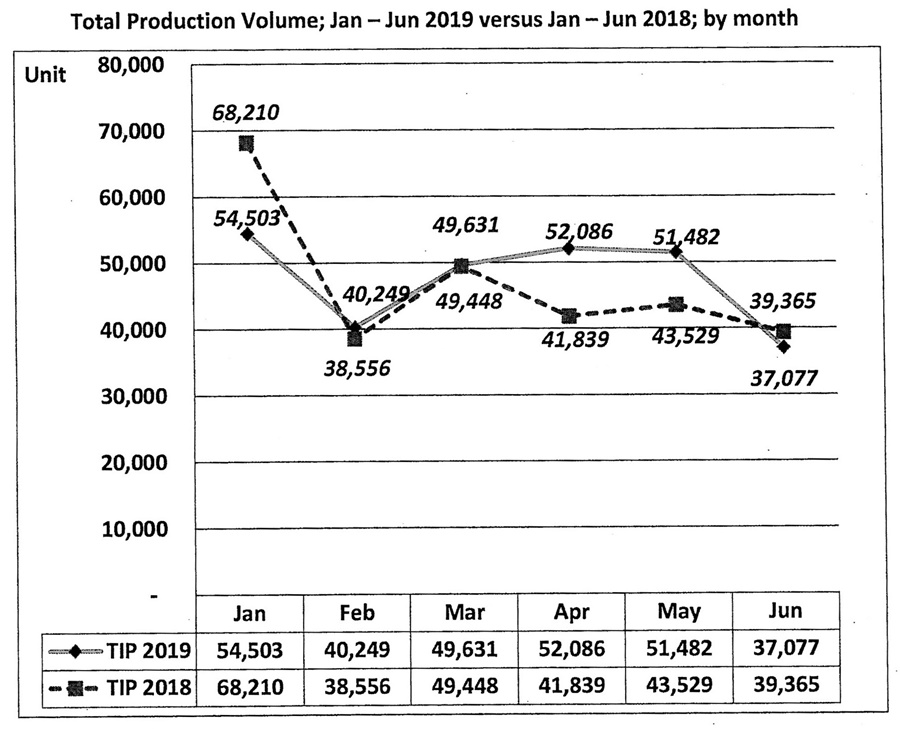

The assembly plants collectively produced 55,775 vehicles in October, compared to 51,789 vehicles in the same month in 2018. The increase was largely in the passenger vehicle segment while the commercial vehicle segment declined.

Cumulative production for 10 months was 481,816 units which was 97% of the cumulative sales volume but this direct comparison may not be entirely accurate as there would be an overlap in stocks and imports. Popular models may leave the plants within days of being completed but there may also be vehicles which don’t move out so fast (although the plants would not want them around too long either as they take up parking space).

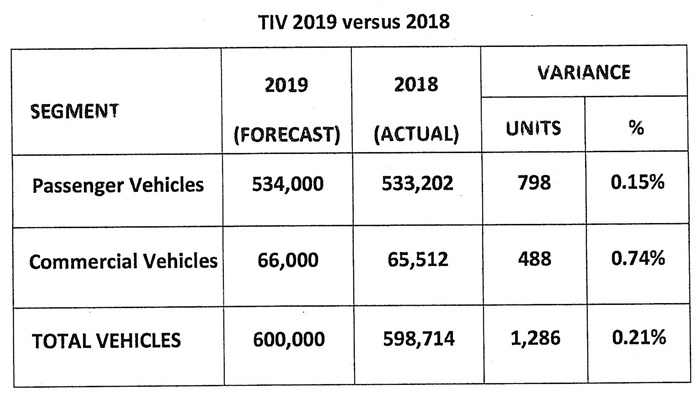

With two months left to the year and a forecast of 600,000 units for the year by the MAA, it means that sales in November and December must average 51,569 units. This year, 5 months have seen the TIV above 50,000 units and it’s often the case that there is such a big boost in December that the forecast is met.