Exports are vital for the business of any carmaker if it is to keep growing. Unless it is the gigantic market in China, every carmaker cannot rely on its domestic market alone for long unless it receives protection and preferential treatment by the government.

For Proton, which did receive such protection for a long time, its focus on the domestic market enabled it to grow without the heavy cost of competing in other markets where it was just another brand. However, with the increasing liberalisation, Proton’s share of the Malaysian market began to erode and although it did export its vehicles, its overseas business was not significant.

While sales leadership in the domestic market will always be a main priority, the company recognises that in order to grow for the future, it needs to expand its customer base and search for sales in other countries. The export market is therefore of great importance to Proton’s long-term goal to be the third best-selling automotive brand in ASEAN by 2027.

Doubling export sales in 2021

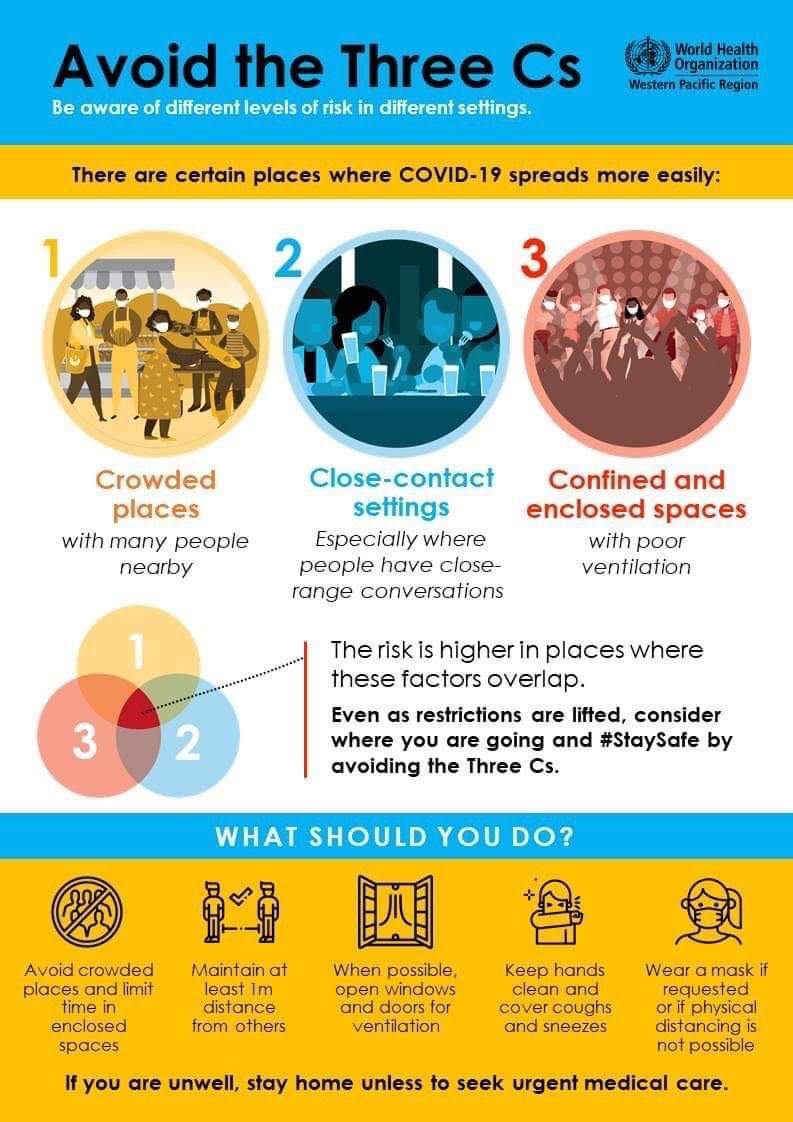

The carmaker is therefore giving much more attention to its export business and has set itself the challenging target of doubling export sales in 2021 compared to what was achieved in 2020. It is setting this target on the assumption that export activities are not overly hampered by restrictions due to the global pandemic.

“Over the last two years, Proton’s international sales division has been aggressively pursuing export sales in numerous markets. We have deployed multiple strategies to achieve our goals, from shipping CBU vehicles built in Malaysia to inking agreements with local conglomerates to assemble CKD cars to benefit from local tax incentives,” said Steven Xu, the company’s Director of International Sales.

“We targeted to see significant gains in 2020 but those plans were affected by COVID-19. Still, we managed to grow our export volume, enter new markets such as Kenya and even launch the Proton X50 in Brunei barely 2 months after its Malaysian debut, so there are many positives to take into the new calendar year,” he said.

Spearheading the export activities will be Proton’s most popular model, the Saga. The X70 and X50 SUVS will also be gradually introduced to more overseas markets. At the same time, setting up local assembly operations in some foreign markets will also boost exports.

Tailoring products to local needs

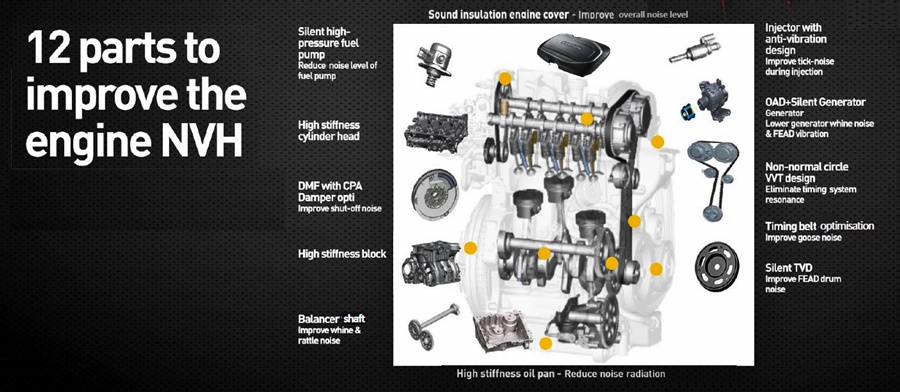

One of the keys to growing exports is having products that not only appeal to a number of different markets but more importantly, meet the needs of the market. Global players take this seriously and many years ago, Honda developed a 1599 cc engine for its Accord model just for the Singapore market when virtually all other markets used a 1602 cc engine.

Likewise, Proton has fitted a 1299 cc engine to the Saga it exports to Pakistan, instead of the 1332 cc unit commonly used, because customers there prefer cars with smaller engines. The same model is also sold in Nepal and comes with a heater, a vital component for markets with cold winter months but not installed in models sold in the ASEAN region.

“The Proton Saga remains a popular model in many countries due to its hardiness, practicality and value-for-money proposition but in order to lift our brand image, it is important for our newer models such as the Proton X70 and Proton X50 to also be exported. This will show car buyers what the company is capable of and help pave the way for us to sell other models in the future to fill up the range,” added Mr. Xu.

While Proton’s distributors and importers in its export markets are owned by local entities, it works closely with them to ensure there is a cohesive market introduction, promotion and product launch plan to suit local market conditions. By building a consistent brand image, the company is taking steps towards being a global entity and paving the way towards penetration in other regions in the future.

Working closely with foreign partners

“By working closely with our foreign partners, we aim to present a consistent message in all our export markets and ultimately, this will make it easier for the Proton brand name to establish itself in even more countries. This is in line with our aim to promote Malaysia and its vendors on a regional and global level and ultimately, this will raise their competitiveness and benefit the economy as a whole,” said the CEO of Proton Edar, Roslan Abdullah, who is not only responsible for Proton’s sales volume but also for the marketing and promotion of the brand.

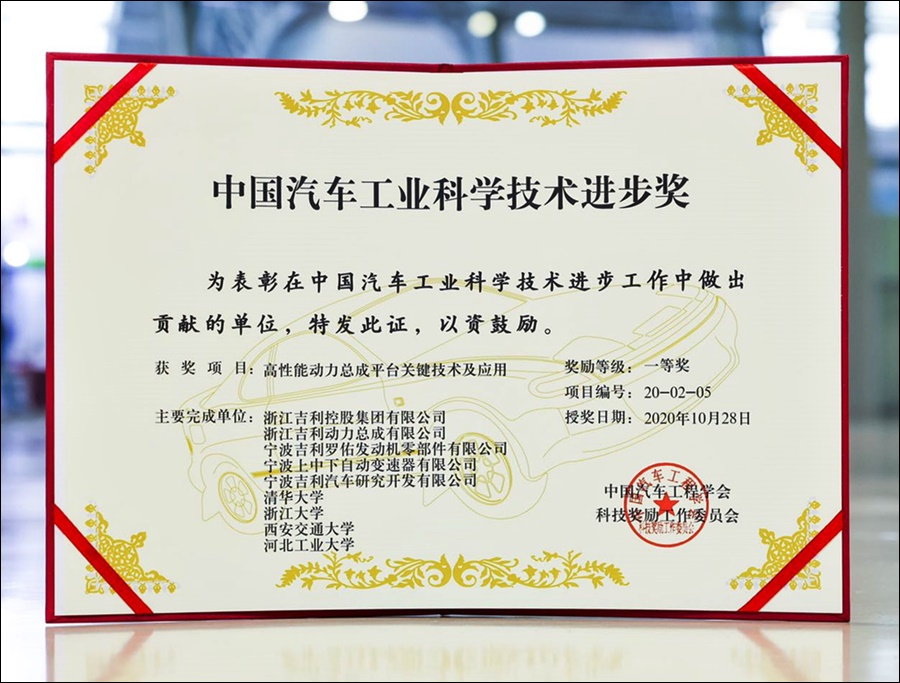

“Our products have not been available in many parts of the world for a variety of reasons. Our new range of updated and jointly developed products with Geely presents an opportunity to change the narrative by opening up ownership to more countries and we are optimistic they will find a ready market in many countries,” he added.

History of Proton exports

In the early years of Proton’s existence, its focus was on the domestic market which took virtually every car it made. Export markets, though established, were not given great attention and even Mitsubishi Motors, its partner, suggested that it concentrate on developing its skills in making cars and about the business before embarking on overseas sales.

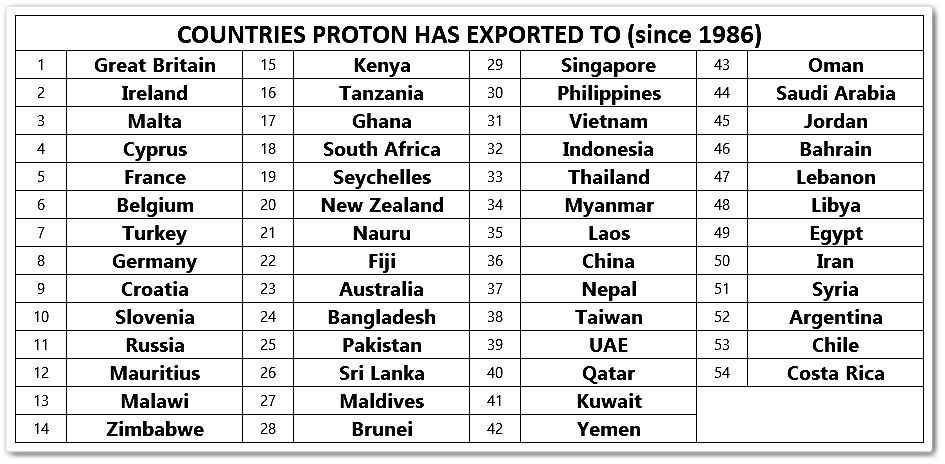

Nevertheless, Proton began exporting just one year after the first Saga went on sale in Malaysia. Its early targets were those which were ex-British colonies, like Malaysia, and where traffic went on the left side of the road like us. This would make it unnecessary to develop a lefthand drive variant so soon.

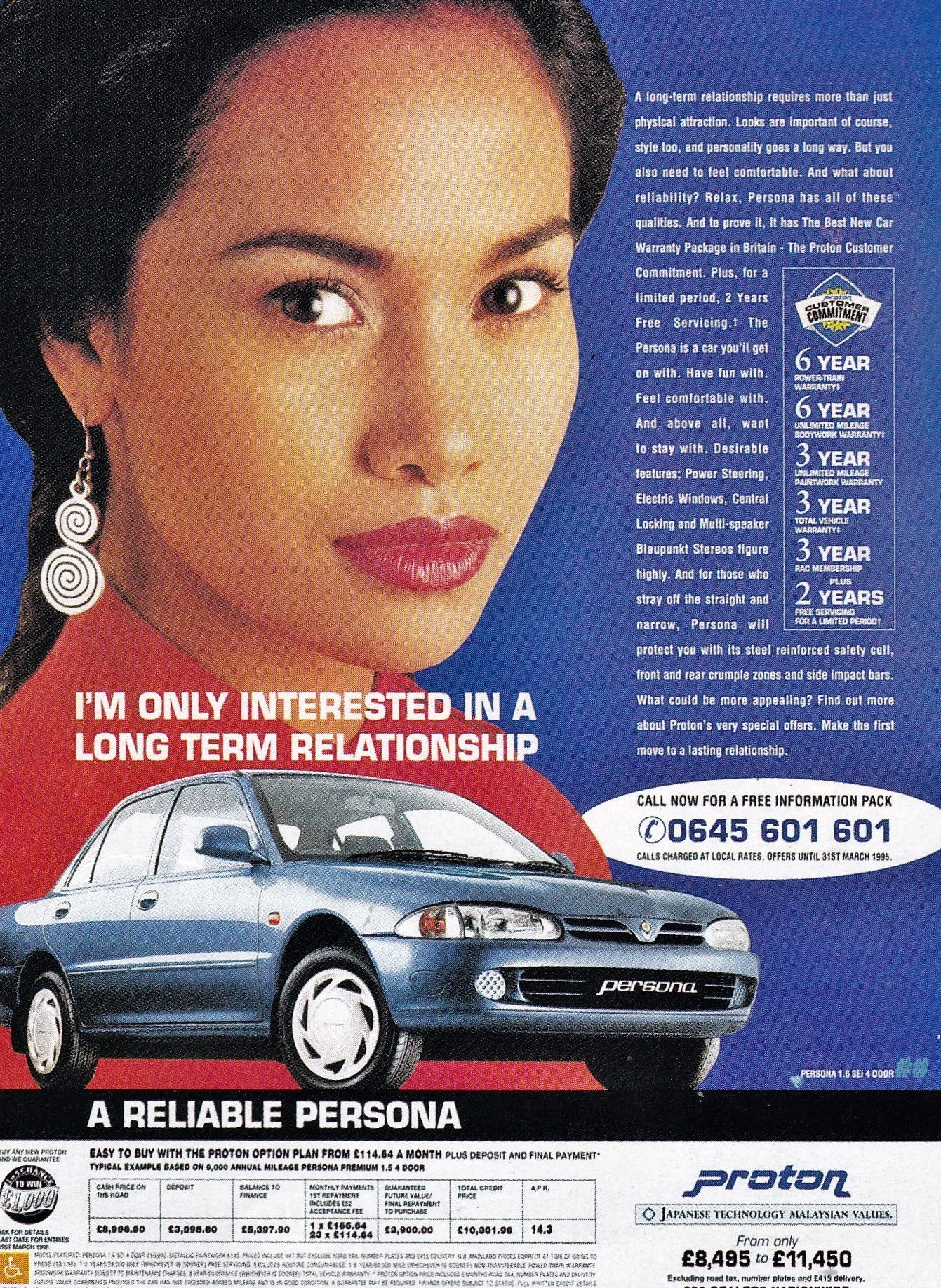

The UK market was considered a market with great potential then, and it was hoped that the Malaysian origins of the Saga would appeal to the British who had lived in Malaysia in the pre-Merdeka period. The first model was introduced at the Birmingham Motorshow in 1988 and initially, Proton received some preferential taxation as it was a small volume brand entering the market. This allowed it to sell at attractive prices and it was well received. The growth in sales in the UK led to a subsidiary being established to handle import and marketing activities, and that market was at one stage, Proton’s biggest export market.

As the only Muslim country in the world to develop its own car and have an automotive brand, Protons from Malaysia were expected to be popular in other Muslim countries. In fact, the first export market was Bangladesh where the Saga first went on sale in 1986. Egypt has also been a strong market for Proton since it entered in 2004.

By 2001, Proton had a presence in over 50 countries, some in significant numbers and some just a handful. It had tried to enter the US market in the late 1980s, appointing a business partner called Global Motors which created a unit known as ‘Proton America’ to get the necessary approvals. Two units of the Saga modified to lefthand drive and with 1.8-litre engines were sent to a motorshow in Las Vegas in 1988. The plan was to export as many as 30,000 cars to the USA for sale within a year. However, things didn’t work out as expected and no further attempts were made to enter the biggest car market in the world at that time.

Like many manufacturers, Proton also considered local assembly in some markets and it did so for a while in the Philippines and had a project going for Iran. It also had a joint venture company with Mitsubishi Motors in Vietnam and the deal was that for models above 1600 cc, Mitsubishi’s models would be used, and Proton would provide models below 1600 cc. But things didn’t proceed as planned and Proton never got to assemble any model.

From 2001 onwards, Proton had a new range of models and hoped to grow its exports, especially as the domestic market would become more challenging as it was supposed to be ‘opening up’ with the realisation of the ASEAN Free Trade Area (AFTA). It even built a new factory in Tanjung Malim, Perak, with a capacity of up to 500,000 units in anticipation of an export offensive regionally.

However, for various reasons, export activities diminished and in Europe, as the emission and safety regulations got tougher, Proton’s aging platforms and engines became unacceptable. By 2010, even the ‘father of Proton’, Tun Mahathir Mohamed, acknowledged that perhaps Proton had not given sufficient thought to the need to make its cars suitable for global markets and only focussed on the domestic market because it was big enough. Dealerships in many of the 50 markets slowly stopped selling Proton which was not so helpful at a time when the company was also facing a decline in domestic sales.

“We are exploring all opportunities to grow export volumes for Proton,” said Dr Li Chunrong, CEO of Proton. “We are also leveraging on Geely’s extensive overseas network operations to increase the cost-effectiveness of Proton’s operations. Geely can support us in these initiatives and there is a lot of experience within the Group so we hope to leverage on it to enable us to sell more cars outside of Malaysia.”