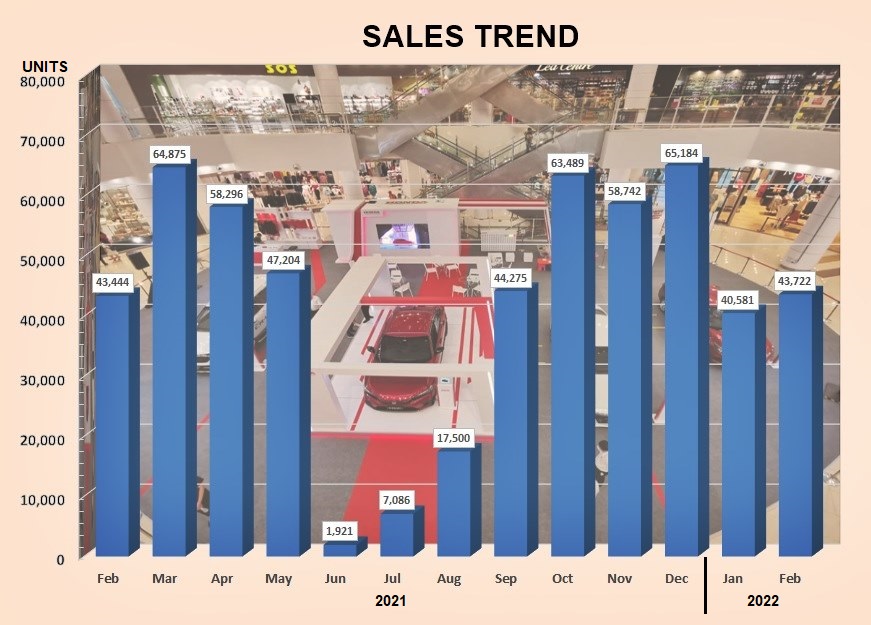

Historically, February is a ‘low’ month as it has the least working days of the year and often, there are also major festive periods during the month, further reducing the number of selling days. However, February in 2022 bucks the trend and saw an 8% increase over January sales to close at 43,722 units. Compared to 2021, the Total Industry Volume (TIV) was quite close, with a difference of 274 units.

The surge in sales (or more correctly deliveries) was due to the big backlog of orders being fulfilled as much as possible. The severe floods in December had caused shortages in the supply chain as some parts suppliers had to suspend operations due to their factories being flooded. This resulted in the TIV for January being lower than it should have been and as supplies resumed, the plants quickly rushed to complete vehicles, and send them to dealers.

The resumption of regular production was reflected in the high output of vehicles from plant in February – 51,291 units, which was 13% more than for the same month in 2021. 92% of the output was passenger vehicles. There are still constraints to production due to the global shortage of microchips and the backlog continues as it is beyond control of assemblers and suppliers.

The upward trend is expected to continue through March which has more working days. The companies still have many outstanding orders to fulfill, while new models are being launched every month. March is also the final month of the financial year for some companies, so they will be pushing hard to finish off with their best possible numbers.

As for cumulative TIV, this year looks like it will be a better year if the performance – in spite of shortages – is any indicator. Within just the first two months, the TIV for sales is 10% higher than the same period in 2021, while the TIV for production is 11% higher. Sales of commercial vehicles (including pick-up trucks) is 33% higher, suggesting that companies are confident enough to expand or update their fleets in anticipation of improving business.

Perodua to surge forward in 2022 with RM1.326 billion investment

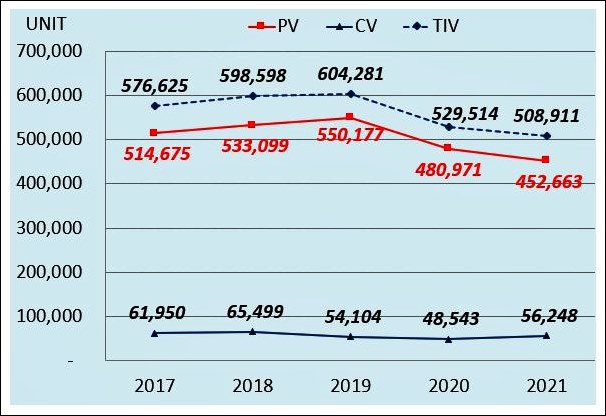

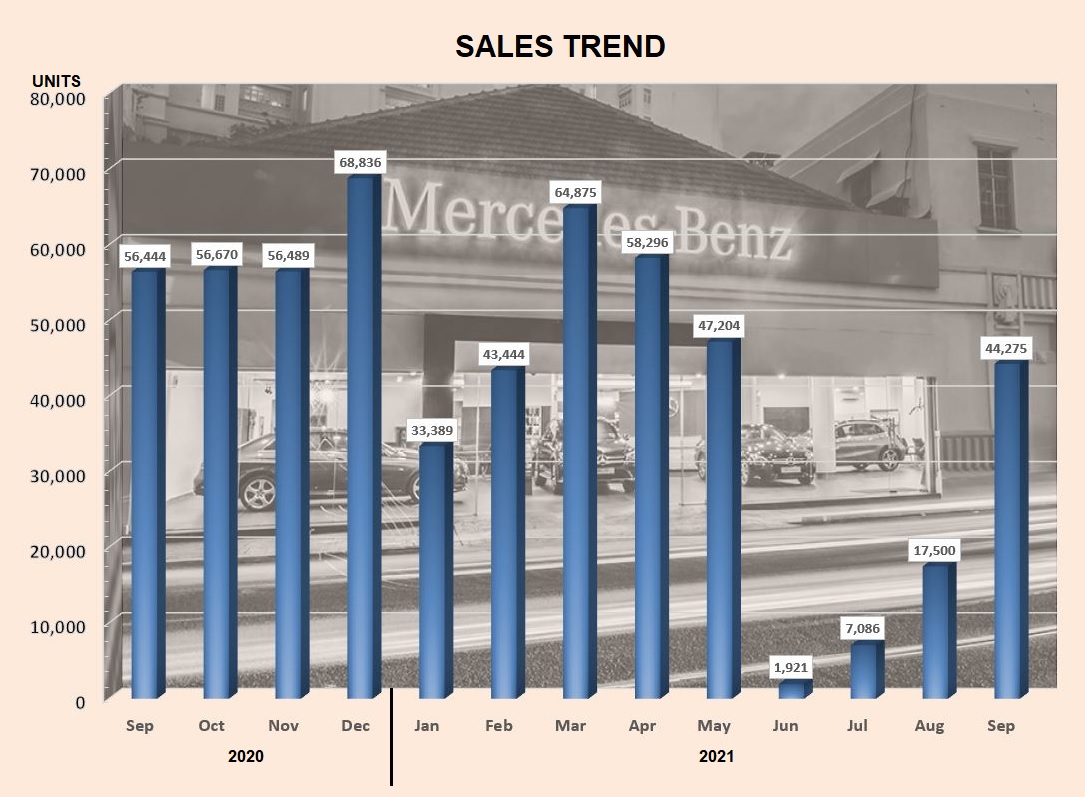

Although 2021 was the second year of the COVID-19 pandemic and the auto industry had been hoping to recover from the impact of the lockdown in 2020, the total number of new vehicles sold was actually lower. Where the Total Industry Volume (TIV) in 2020 was 529,514 units, the TIV for 2021 was 4% lower at 508,911 units.

Nevertheless, the usual final-month push by car companies saw the December having the highest sales volume of the year with 65,184 vehicles delivered nationwide. This contributed to the year’s TIV going past the 500,000-unit level that had been forecast by the Malaysian Automotive Association. While 2021, like 2020, had long periods when business activities – including motor vehicle sales and production – were suspended, the rate of recovery in 2021 was not as quick as the year before.

Commenting on the sales figures, MAA President Datuk Aishah Ahmad said that the measures taken by the government were important factors. “The much smaller TIV’s contraction recorded in 2021 [compared to 2020] can be attributed to the measures and wisdom of our government in balancing between saving lives and jobs so as not to jeopardize the domestic economy,” she said.

Owing to the relaxation of the movement control orders, many economic sectors were allowed to re-open for businesses. This helped to improve business confidence which contributed to more sales of new vehicles, including commercial vehicles which are much needed for the running of businesses. Having deferred purchases during 2020, many companies would have made their fleet purchases during 2021 to support their business activities.

“The extension of the sales tax exemption incentive under PEMERKASA+ package till December 31, 2021, also helped to sustain the demand for new passenger vehicles,” added Datuk Aishah. “Under the PEMERKASA+ package, the government agreed to exempt sales tax up to 100% for completely knocked down (CKD) passenger vehicles assembled in Malaysia, and 50% on passenger vehicles that were imported in completely built-up (CBU) form.

In the passenger vehicle segment, it was evident that even more buyers preferred SUVs, mirroring the global trend which has had manufacturers hurriedly launching new SUV models. In the case of Malaysia, passenger car sales declined by about 19.7% while SUVs grew by 43%. The other segments – MPVs (which used to be second to passenger cars) and window vans – also saw lower sales although not significantly different from their 2020 volumes.

Overall, passenger vehicle sales fell by 5.9% to 452,663 units but this was not entirely due to reduced demand. Some companies also experienced stock shortages due to the semiconductor microchip supply issues which affected their local production or production at overseas factories from which they import their vehicles. It only takes one part being unavailable to prevent a vehicle from being completed and leaving the factory.

The commercial vehicle segment (which includes pick-up trucks)) fared better, recording an increase of 15.9% to a volume of 56,248 units, which represented 11% of the TIV. In this segment, pick-up trucks registered the biggest increase of 20.9% to 40,736 units, account for 72% of the commercial vehicle segment.

The growth would have been helped by the introduction of new models like the Isuzu D-MAX during the year. The all-new generation of the popular pick-up truck was launched in April and Isuzu Malaysia reported that average monthly orders were 100% higher than the previous generation.

The bigger commercial vehicles saw lower sales; bus sales, for example, fell by almost 50% between 2020 and 2021 although this would be understandable in view of the situation. With restrictions on interstate travel for much of last year and borders with Thailand and Singapore pretty much closed, tour companies would not have wanted to get new vehicles. However, truck sales did go up by 5.3%, probably in view of increasing demand for delivery services.

Although the factories were forced to shut down for an extended period, the drop in local production was actually minimal – 3,535 units or 0.7%, compared to 15% in 2020 when the drop from 2019 was almost 87,000 units. While passenger vehicle production declined by 11,324 units (2.5%), commercial vehicle production actually rose by 7,789 units (28.4%). Outputs rose for trucks and panel vans which, as mentioned earlier, had greater demand.

Looking ahead in 2022

Notwithstanding pandemic-related issues that can cause disruptions and supply chain issues such the global shortage of semiconductor chips, rising cost of freight, there are still some positive aspects that can boost new vehicle sales in 2022.

Continuation of the sales tax exemption for imported and locally assembled passenger vehicles till June 30, 2022 will be helpful in encouraging people to buy new vehicles. Bank Negara Malaysia’s decision at its Monetary Policy Committee (MPC) meeting in November 2021 to maintain the benchmark Overnight Policy Rate at 1.75% will provide additional policy stimulus to accelerate the pace of economic recovery. This may help to stimulate domestic spending including for high-cost items like motor vehicles, and with the economic recovery will come more consumer spending.

Therefore, the MAA is optimistic that the industry will accelerate its recovery in 2022 and is forecasting growth of 17.9% over the 2021 TIV. This would take the volume to the elusive 600,000 units that has been difficult to reach (the last time was in 2019 when the TIV was 604,281 units). The MAA expects the passenger car segment to grow by 19.3% and account for 540,000 units, with the commercial vehicle segment (which includes pick-up trucks) growing by 6.7% to 60,000 units.

Looking further ahead, the MAA expects 2023 to be a boom year as recovery continues with rising demand after 2022. It forecasts a 7.5% increase to 645,000 units then but then the market will slow down again with average growth of around 2% annually up to 2026. Of course, much depends on how the pandemic runs its course although the government has made it clear that there will not be lockdowns again (apart from targeted ones, if really necessary).

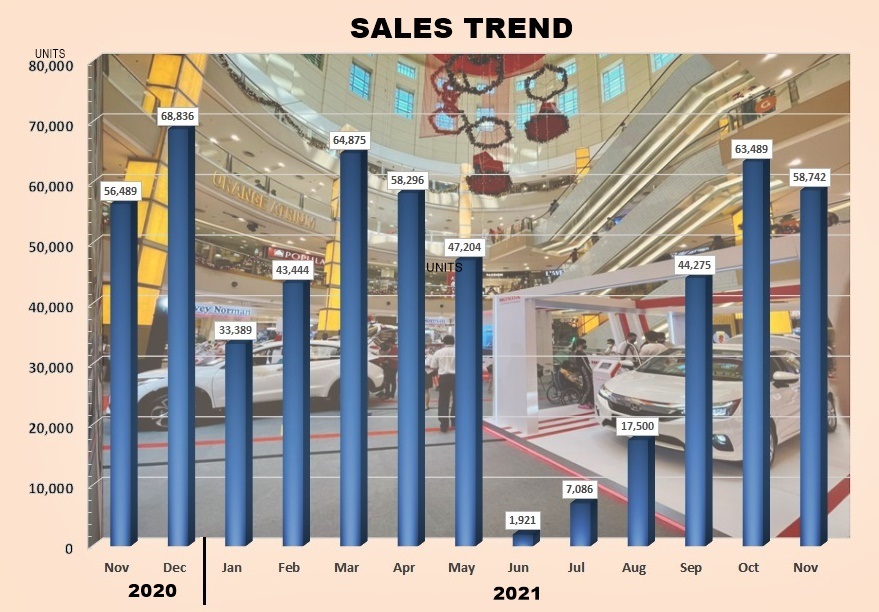

The Total Industry Volume (TIV) for November was 58,742 units, a drop of 7.5% from October and 4% less than what was recorded in November 2020.

This decrease was attributed to reduced supplies of certain models due to the global shortage of microchips (as well as some parts), and some members of the Malaysian Automotive Association (MAA) also believe that customers may have deferred plans to purchase their new vehicles after learning that the sales tax exemption would be extended till June 30, 2022.

Although there are production delays at some plants due to shortage of parts, the total output in November of 58,0-79 units was 6% higher than for the same month in 2020.

The cumulative TIV over 11 months reached 441,136 units – 4% below the volume achieved for the same period in 2020. This means that the industry would have to deliver 58,864 vehicles in December to hit the forecast of 500,000 units. While the MAA is optimistic that there will be a higher TIV in December, it is hard to predict just how much higher due to the supply issue. Typically, there is a significant jump at the end of the year with promotions and a final push by companies to get the best numbers before they close the year’s books. In 2020, the TIV went from 56,489 units in November to 64,836 units.

Production disruptions reduce Perodua deliveries in November by 27.1%

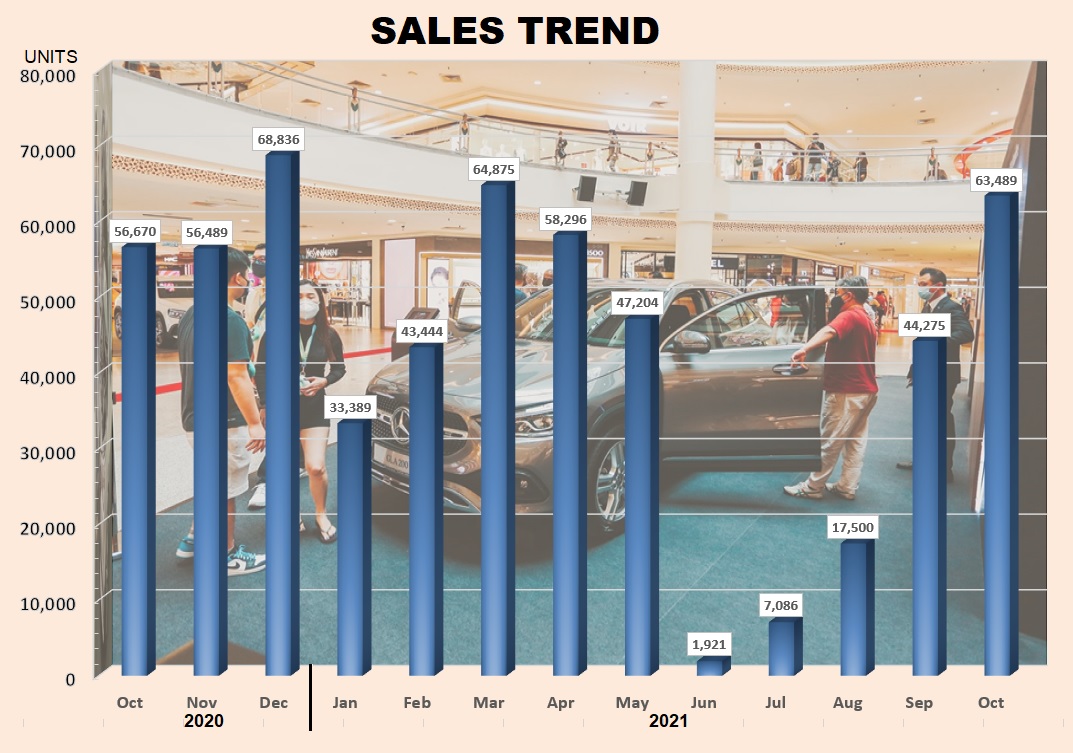

With more days in September and continued progress towards normalising activities in the business sector, new vehicle sales continued to rise. Although 4.8% lower than October 2020, the Total Industry Volume (TIV) of new vehicles registered in the month was 43% higher than September.

It’s uncertain how much of the increase was from new orders as the more popular models from the two leading Malaysia carmakers – Perodua and Proton – have a backlog. Production has been interrupted due to the global microchip shortage which worsens the situation of delayed deliveries which was already evident before the long period of lockdown.

Cumulatively, after 10 months, the TIV has not reached the same level as the 10-month period in 2020 and the 2021 TIV is 382,379 units or 5% lower than the same period in 2020.

The plants have been working flat out to raise output but there is also a dependence on their suppliers, some of whom have their own production issues and disruptions. For this reason, Perodua has ensured that the ‘ecosystem’ remains as intact as possible by helping its suppliers in various ways so that they do not have to shut down.

Compared to the same month in 2020, total output in October 2021 was 12% higher with 61,248 passenger vehicles (excluding pick-up trucks) and 4,162 commercial vehicles assembled.

From January to October 2021, the total number of vehicles produced was 369,406 units, about 5,000 units less than the same period in 2020.

The Malaysian Automotive Association (MAA) expects that the TIV has reached a plateau and November numbers will be similar. There may, however, be disruption to supply of imported vehicles as the plants in other countries may be hampered by the microchip shortage. Generally, companies like Perodua expect to be able to maintain production levels until the end of the year as they have a commitment from their suppliers but are undertain of the situation in 2022.

20 years ago, Perodua’s average monthly sales were around 7,800 units; 10 years ago, the monthly average rose to 15,000 units and the brand was No.1 in the market with a 30% share in 2011.

In October 2021, Perodua delivered 27,858 vehicles throughout Malaysia, setting a new record after the last record of 26,848 vehicles was set exactly 12 months earlier. For this achievement, the brand has been given a listing in the Malaysia Book of Records.

The new record comes with improved production and swift deliveries of vehicles to customers as the Malaysian carmaker is trying to deliver as many vehicles as possible in the fourth quarter of 2021.

The 27,858 units consisted of 8,761 (31.4%) Myvis; 5,973 Axias; 5,257 Bezzas; 3,973 Ativas, 2,553 Alzas, and 1,341 Aruz. For the first 10 months of this year, Perodua delivered 146,951 units, 14.5% less than the 171,861 units reported in the same period of 2020.

“This achievement is our commitment towards our customers and represents a 90.67% increase from 14,160 units sold in September 2021. We are now working to further improve production, especially for the rest of the year,” said Perodua President & CEO, Dato’ Zainal Abidin Ahmad said.

Together with the sales record, the month of October also saw the highest ever number of vehicles made at the two factories – 29,803 units. According to Dato’ Zainal, this output was beyond Perodua’s current production capacity, yet the staff was able to boost their productivity with the same level of quality without new people, equipment or machinery.

“I wish to take this opportunity to thank the Perodua staff who have gone beyond their best to ensure that our customers receive their Perodua vehicle as quickly as possible,” Dato’ Zainal said.

He added that the company is constantly mindful of both the safety and health aspects by ensuring that all employees follow the COVID-19 prevention guidelines while, at the same time, ensuring that they go beyond all quality requirements.

On the extension of the sales tax exemption until the end of June 2022, Dato’ Zainal said it is most welcomed as it will allow the automotive ecosystem more room to recover from the recent lockdown as well as catch up with demand.

“The extension of the Tax Sales Exemption will also benefit everyone, from consumers to vehicle manufacturers to suppliers, who are also affected by the global semiconductor supply shortage,” he added.

“The remaining two months will be a challenge as both Perodua and its ecosystem are still facing supply challenges due to the ongoing pandemic and we sincerely thank our customers for their patience and understanding in terms of vehicle delivery,” he said.

Perodua sales picking up but sales target for 2021 is lowered by 10.8%

The Total Industry Volume (TIV) for the month continued to rise for a third consecutive month, September being the first full month of business after the long forced suspension of activities. The TIV increased by 153% compared to August sales, translating to a volume difference of 26,775 units.

Of the 44,275 units, 38,315 were passenger vehicles (excluding pick-up trucks) while 5,960 units were commercial vehicles (including pick-up trucks). Pick-up trucks account for between 65% to 70% of commercial vehicle sales.

Compared to the same month in 2020, however, the TIV in 2021 was 23% lower. The gap for cumulative sales over 9 months was smaller at 7%; in the same period last year, 344,019 vehicles were sold whereas in 2021, the total number reached only 318,874 units.

According to the Malaysian Automotive Association, some companies are affected by the global chip shortage and are having delays in deliveries to customers. This situation affects CBU models as well as those that are locally assembled although not equally at different plants.

Production nevertheless has been climbing in the same manner as sales numbers, with most plants able to operate at full capacity. The government allows those factories with a minimum of 80% of their workforce fully vaccinated to carry out operations with full attendance.

The total production volume for September was 229% greater than the output in August, with 45,972 vehicles assembled. Of this number, 42,556 units were passenger vehicles.

Cumulative production from January to September reached 303,996 units, 4% lower than the 315,863 units that were assembled over the same period in 2020.

The MAA expects October sales to show continued increase as output of vehicles is pushed as much as possible, while the companies are doing their best to meet 2021 targets if possible. There are still a few new models that will be launched before the end of the year so customer interest will be high. And of course, towards the end of the year, there will also be promotions that will entice many to buy a new vehicle.

Perodua sales and deliveries accelerating with 102% increase between September and August

The COVID-19 pandemic has had a big impact not only on people (many of whom lost loved ones) but also on businesses. Apart from reduced business due to restricted movements, forced suspension of activities also made things worse. But now things seem to be heading towards some normalcy and as life gradually returns to normal, businesses are seeing a steady improvement in sales.

In the auto sector, which was allowed to resume operations from the second half of August, the number of new vehicles produced, sold and delivered also rose significantly in September, the first full month of operations.

UMW Toyota Motor (UMWT) reports a total sales volume of 8,033 vehicles, an increase of 5,509 units over the August volume. This was made up of 7,931 Toyota vehicles and 102 Lexus vehicles. The volume was also 43% higher than for the same month in 2020 when 5,605 vehicles were sold.

On a cumulative basis, year-to-date sales of Toyota and Lexus vehicles in Malaysia reached 43,594 units at the end of September. In the same 9-month period in 2020, the total volume reached only 25,978 units, an indication of the severity of the first Movement Control Order (MCO) during the second half of 2020.

“We are certainly pleased to see the market steadily moving towards normalcy as the past few months have been challenging for us. Our showrooms have been open and receiving many customers daily, and bookings for the latest models have been increasing. As a result, our total sales in September for Toyota and Lexus vehicles was a phenomenal 223% greater than the August volume,” said President of UMW Toyota Motor, Ravindran. K.

All SOPs followed

Mr. Ravindran said that even before the lockdown was lifted, all facilities had been sanitized and ready for visitors in accordance with the Standard Operating Procedures (SOPs) specified by the Ministry of Health. The SOPs are now strictly observed at all outlets and a company-wide program was undertaken to ensure that the entire workforce is fully vaccinated.

“I would like to assure our customers that they will be safe and protected when they visit our showrooms or service centres but at the same time, we remind them that they need to comply with the SOPs. This means having temperature scans and registering their visit using the MySejahtera app, as well as using hand sanitizers and facemasks at all times,” he said.

‘Visit & Win’ promotion

To welcome visitors back to Toyota showrooms nationwide, UMWT is having a ‘Visit & Win’ promotion with a total of RM30,000 worth of prizes to be won. You do not have to buy anything at all; all you need to do is visit any authorised Toyota showroom, take a picture and then upload it to social media (eg Facebook or Instagram) with a caption. Once it is posted, let UMWT know what the URL is so that it can be viewed and judged.

There are 38 prizes to be won, with the Grand Prize being an iPhone 12 (64GB); 2 second prizes of Samsung 55-inch 4K LED TV; and 2 third prizes of Dyson Supersonic Hair Dryer Iron. Consolation Prizes are TT Racing Maxx Gaming Chairs, Bose Quiet Comfort 35 Wireless Headphones, Kingston HyperX Gaming Keyboard, Philips Portable Car Air Sanitizer, and customized Touch’nGo cards with RM100 pre-loaded. Additionally, everyone visits the showroom will receive a free Safety Kit (which stocks last).

Those who plan to buy a new Toyota vehicle can enjoy low instalments with Toyota EZ Beli. If they are government employees, UMWT has the Jom Drive program (in collaboration with Toyota Capital Malaysia) with special benefits and a selection of financial plans. Applications (with supporting documents) will be hassle-free and processed speedily so that they can enjoy their new Toyota within a short time.

Loyal customers not forgotten

“Our loyal customers who have supported the brand for more than 5 decades are also not forgotten. We now have the new Toyota Loyal-T program with better service and bigger rewards,” Mr. Ravindran added. “The program makes use of the Toyota Drive mobile app for convenience and ease of communicating with UMWT.”

With business activities now normalizing, UMWT has been busy preparing for an exciting future when Hybrid Electric Technology is introduced with Toyota models assembled locally. These new models will have more efficient powertrains with less emissions and quieter running.

“Toyota Hybrid Electric Vehicles (HEVs) are at their most advanced today, and are the immediate and economical solution for mass market production and sale in terms of reduced CO2 emissions, practical usage, and price acceptance by customers. We are absolutely positive that the HEV is the most accessible and realistic choice for Malaysian customers in terms of practicality and infrastructure, with an enormous potential in Malaysia,” said Akio Takeyama, Deputy Chairman of UMW Toyota Motor.

UMW Toyota Motor introduces Toyota Synergised Mobility to present a new aspect of the brand

Proton, like other carmakers in Malaysia, has been seeing a steady sales growth since the government allowed businesses to start operating again from the middle of August. While there were only two weeks of operations in August and many sales outlets also had to prepare their premises to meet SOPs, September was a full month and customers began returning to showrooms.

For Proton, September was very encouraging as the total number of vehicles sold (including exports) was 10,380 units. The company estimates that the Total Industry Volume for the month will be around 43,500 units and, on that basis, Proton’s share would be 23.9%. This would keep it in second place in overall sales for 2021.

September’s sales volume takes the cumulative volume sold to 73,017 units after 8 months. That’s almost similar to the 73,547 units over the same period in 2020 although this year, Proton’s market share to date is slightly higher at 23% compared to 21.5%.

Although there is usually more news about the newer models like the X70 and X50, it was the Saga that was Proton’s bestseller in September. 3,907 units were sold, a number said to be the highest in the A-segment.

The newly launched Iriz and Persona also recorded strong first month sales. Even though production was affected by a shortage of components, the factory still managed to release 1,440 units of the Persona and 749 units of the Iriz (including the new Active variant) which were immediately delivered to customers.

As for the hotselling SUVs, deliveries accelerated to catch up with demand. For the X50, 2,431 units were delivered while 1,577 units of the X70 reached their new owners. To date in 2021, 27,312 units of SUVs have been sold by Proton which accounts for 37.4% of the overall year’s sales of 73,017 units.

“As the numbers show, sales were strong for Proton in September, so we are happy with the results. While we could have sold more than the 10,380 units achieved, some context should be given to our performance as Malaysia is recovering from a pandemic that is still affecting our vendors. The situation is slowly improving but the shortage of chips and other components is a real issue that will not change in the short term, so we must exercise caution when trying to forecast sales as production volumes remain subject to change,” explained Roslan Abdullah, CEO of Proton Edar.

“Therefore, for the remaining three months of the year, Proton will concentrate on meeting our commitments to our customers and delivering as many cars as possible. Clearing the backlog will free up more volume for the next calendar year and help us move forward with plans to expand our offerings both locally and in export markets,” he said.

Encik Roslan said that while there is growth in the number of bookings made online, Proton and its dealers have made big investments to upgrade the sales and service network the last few years. “The best brand experience is still delivered in person, so we have adopted new operational procedures in light of the pandemic situation,” he added.

With all states in Phase 2 or higher of the National Recovery Plan, all Proton outlets and service centres have now reopened nationwide. While operations remain governed by strict SOPs to limit the physical number of people at a facility, fully vaccinated customers can visit showrooms to view and test drive the company’s range of offerings.

EON now has a website dedicated to Proton products and services

© Copyright – Piston.my 2023 Trademarks belong to their respective owners. All rights reserved