It looks like the Chinese carmakers are steadily establishing their presence in the ASEAN market as sales are growing for some of the brands that have entered a few years earlier. This is not their first approach as they began to appear in the 2000s. But back then, their products were not of the same quality as what consumers had come to be used to from the Japanese and Korean brands, so they quietly faded away. Chery was one of them, having tried its luck in Malaysia and even did some local assembly but pulled out in the end.

Today, the Chinese carmakers have progressed greatly and have improved quality as well as made technological advancements themselves. With the government having given a push towards electric vehicles (EVs), they have had to develop EV technology as quickly as possible while competing with each other for a slice of the biggest vehicle market in the world.

Having their own EV technology and products is timely, of course, as government around the world are pushing the auto industry to take definite action to address climate change. Going electric is one approach and countries like Indonesia have offered attractive incentives that are drawing carmakers there to grow their EV business.

Wuling Motors, through its SAIC-GM-Wuling (SGMW) joint-venture with General Motors, is aiming to do just that and develop Indonesia into a major overseas market. Over the past 15 years, it has gained experience in export sales, having sold one of the most popular small vans in Asia. In 2021, SGMW exported over 140,000 units from China to more than 40 countries and regions.

Now it intends to also promote its new range of models developed on its Global Small Electric Vehicle (GSEV) platform. And for the debut of its first global-market zero-emission vehicle – the Wuling Air EV – it chose Indonesia for the world premiere. Apart from the country’s attractive incentives for EV players, SGMW already has a significant presence and a manufacturing plant.

The Wuling Air will be the first EV model that SGMW will sell outside China and has been selected as the official car partner for the 2022 G20 Summit to be held in Indonesia this November. It is likely that the model will be assembled in Indonesia where there can be significant economies of scale and flexibility.

Furthermore, with the provisions of the ASEAN Free Trade Area (AFTA) agreement, the EV can be exported to other markets in the region duty-free. Of course, for Malaysia, that will be the case anyway since there is presently full exemption on import duties for BEVs (battery electric vehicles).

It is likely that SGMW will produce LHD versions in China for the domestic market, complementing the joint venture’s current EV portfolio that has the Wuling Hong Guang MINIEV, Wuling Nano EV and Baojun KiWi EV. Indonesia could thus become the production hub for RHD versions.

The Air EV is the Wuling’s fourth next-generation vehicle to adopt the brand’s new look with a new design language. It has a modern appearance that is somewhat different from other small EVs, with a front fascia that features a horizontal bar extending to the sideview mirrors, and integrated LED daytime running lights.

Size-wise, there are two versions – one with a long wheelbase (LWB) and the other with a shorter wheelbase (SWB). From information released in Indonesia, it appears that only the 4-seater LWB will be offered outside China. This has a length of 2974 mm, width of 1505 mm and height of 1631 mm with a wheelbase measuring 2010 mm. The SWB version can accommodate only two persons and is 2599 mm long with a wheelbase of 1635 mm.

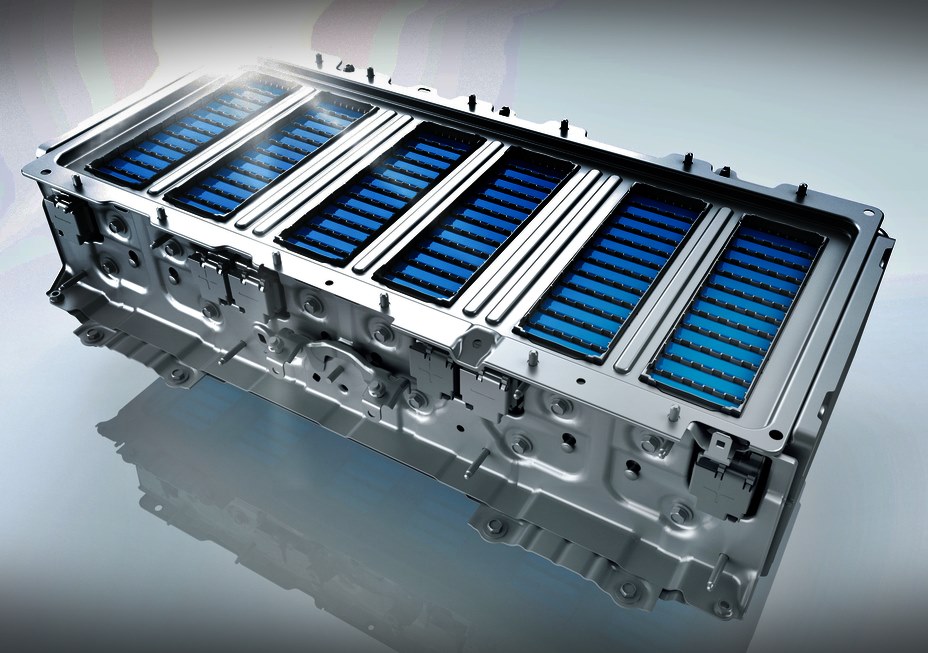

These are certainly very small cars as a Perodua Axia is 3645 mm in length. And while it is often said that an EV doesn’t have a heavy engine, the lithium iron phosphate battery pack is still heavy. In spite of being smaller than an Axia which weighs 825 kgs to 860 kgs, the Air EV LWB weighs 860 kgs, while the SWB version is 100 kgs less.

The powertrain will be fairly basic with a single motor driving the front wheels. There will be a choice of 30 kW or 50 kW and also Standard and Extended ranges of 200 kms and 305 kms, respectively. Top speed is claimed to be 100 km/h which is probably as fast as you would want to go in such a small car.

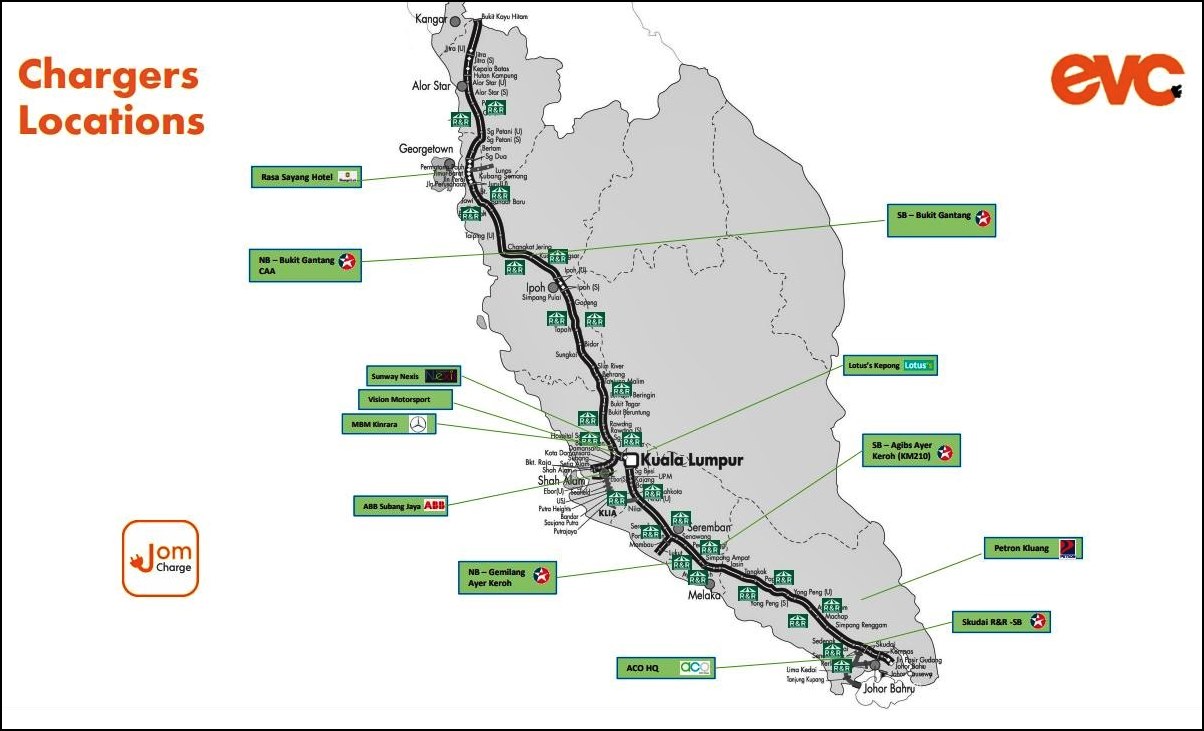

The price in Indonesia is rumoured to start from 275 million rupiahs (about RM84,000) and while that is down to the Honda City/Toyota Vios level in Malaysia, Perodua and Proton offer cheaper cars – and they are more spacious too. So we can’t see the Air EV coming in and besides, with the still-limited recharging network, many will be hesitant to invest in a car which could be stuck in some kampung in the rural areas because its battery can’t be recharged. Presumably, Indonesia’s plan to raise EV adoption will see a rapid development of the recharging network around the country.

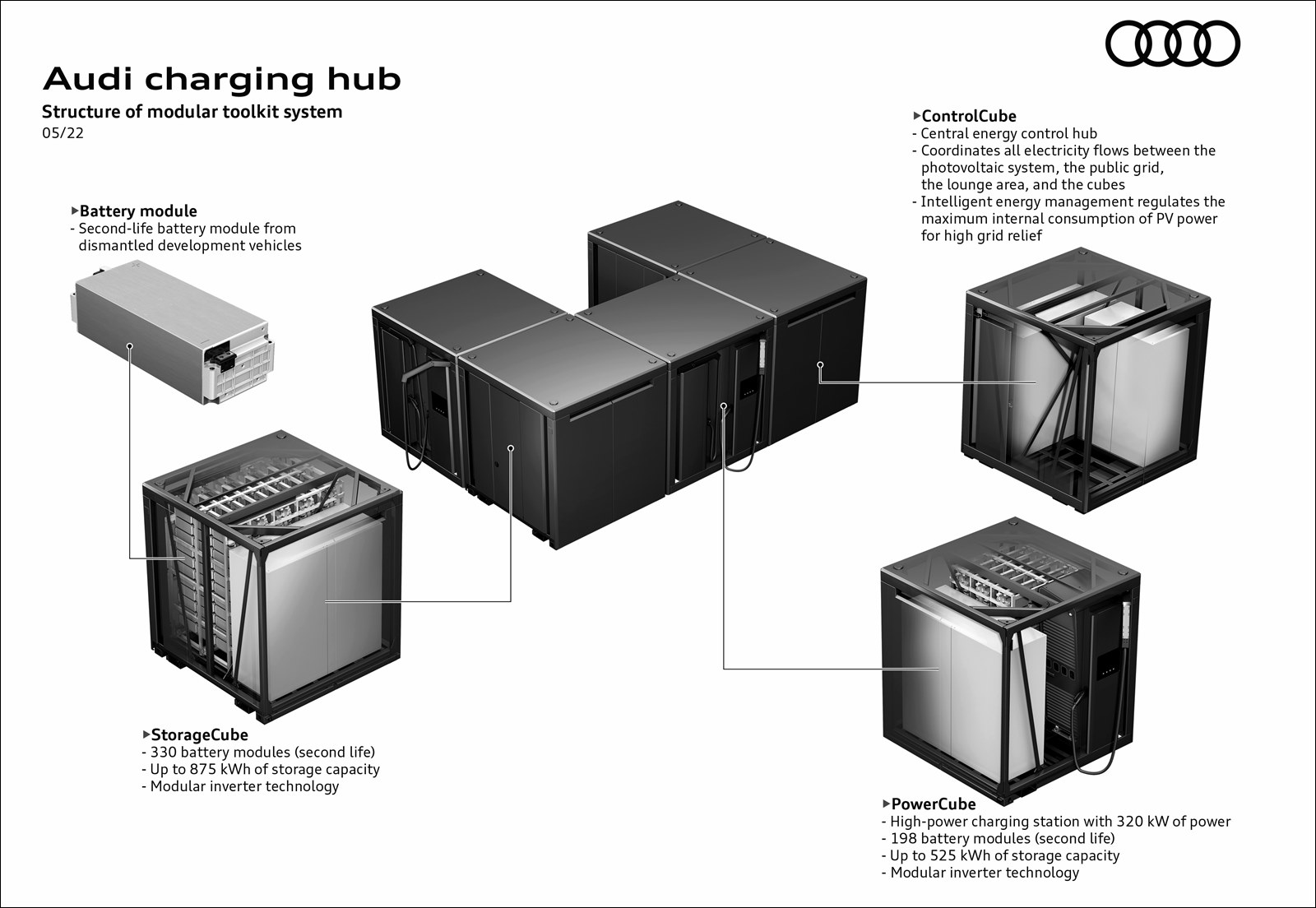

The reality of producing and running electric vehicles