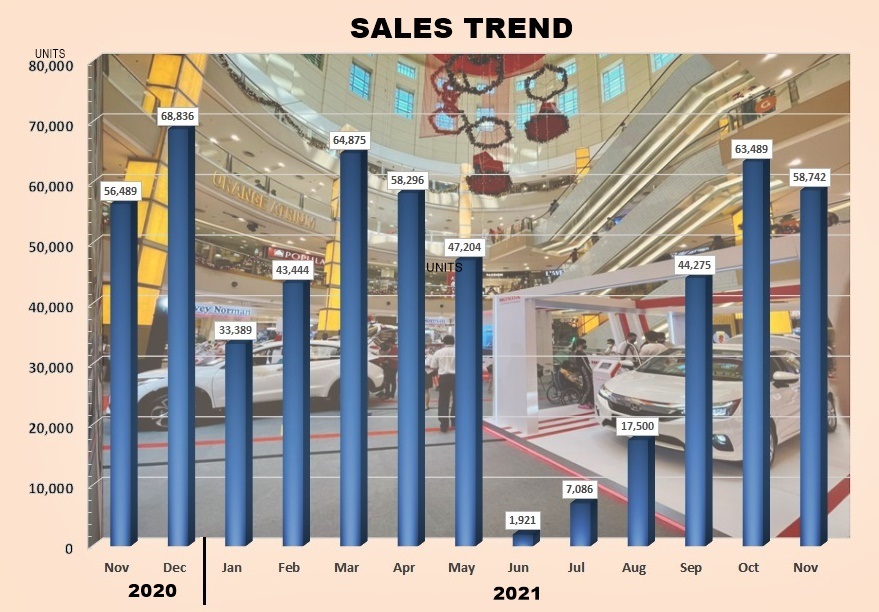

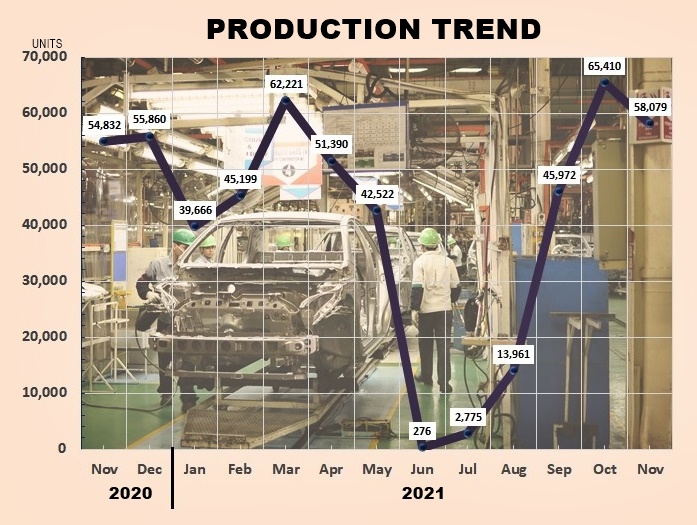

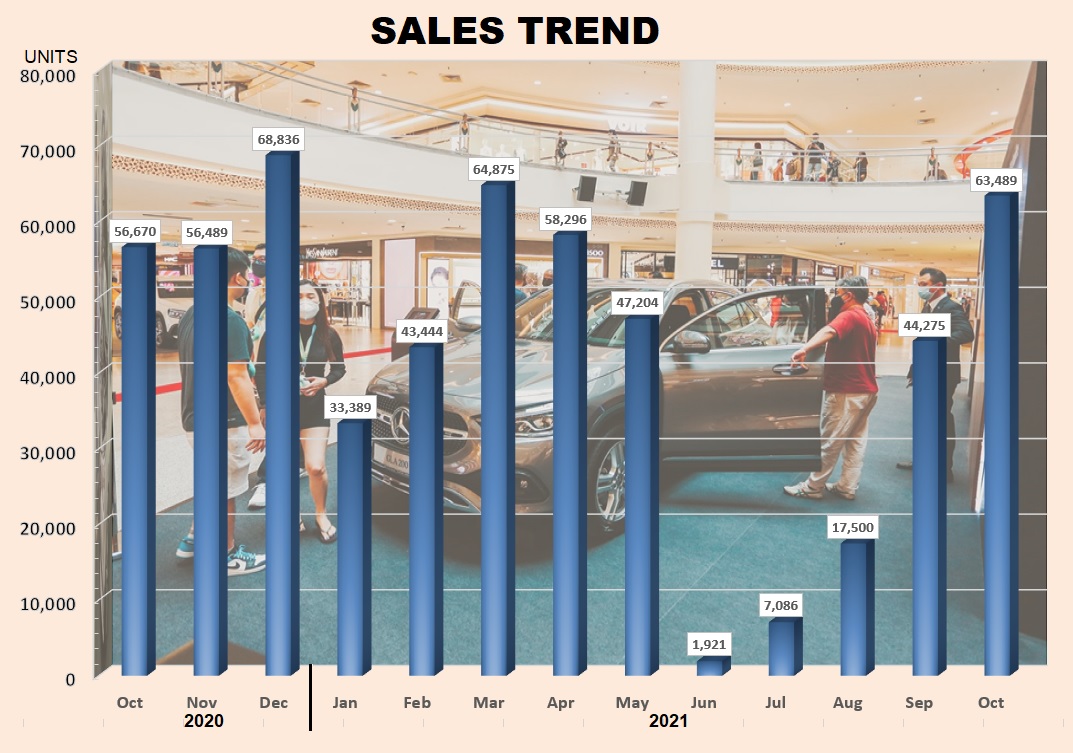

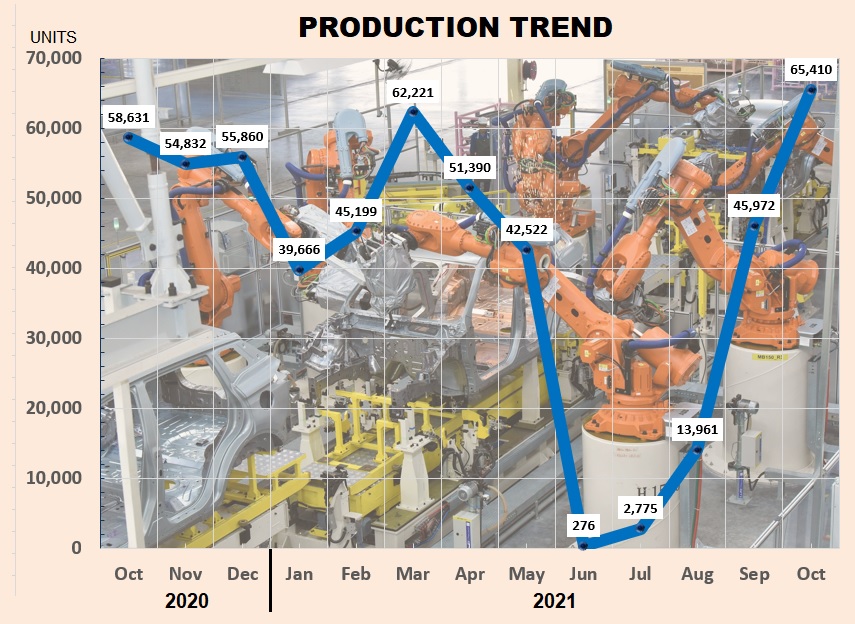

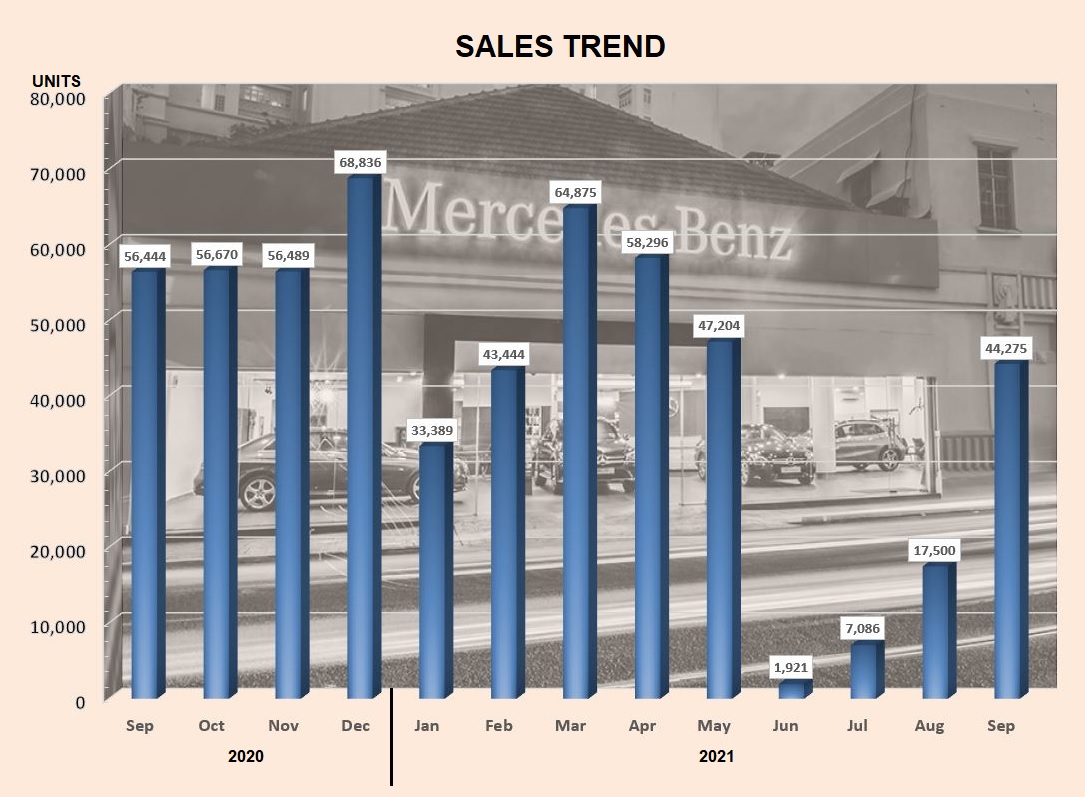

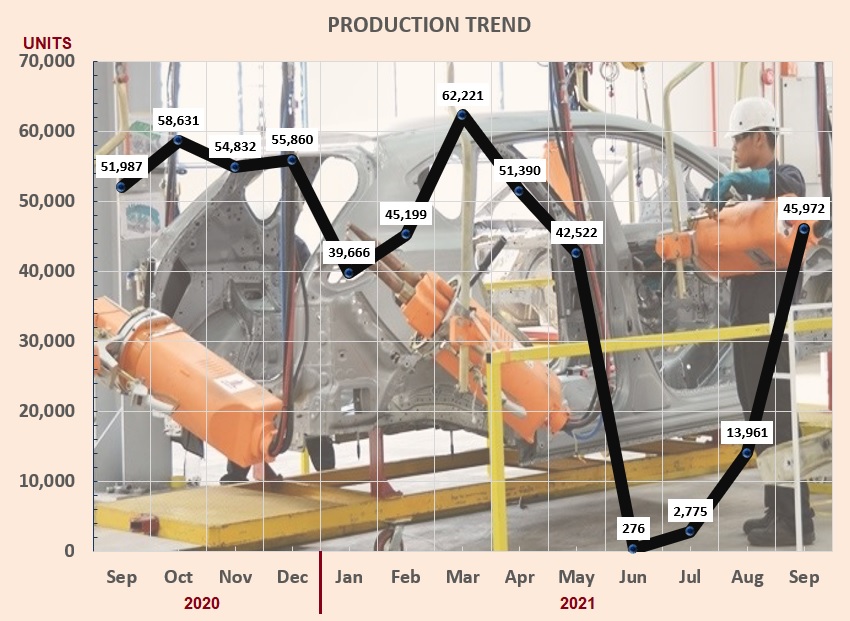

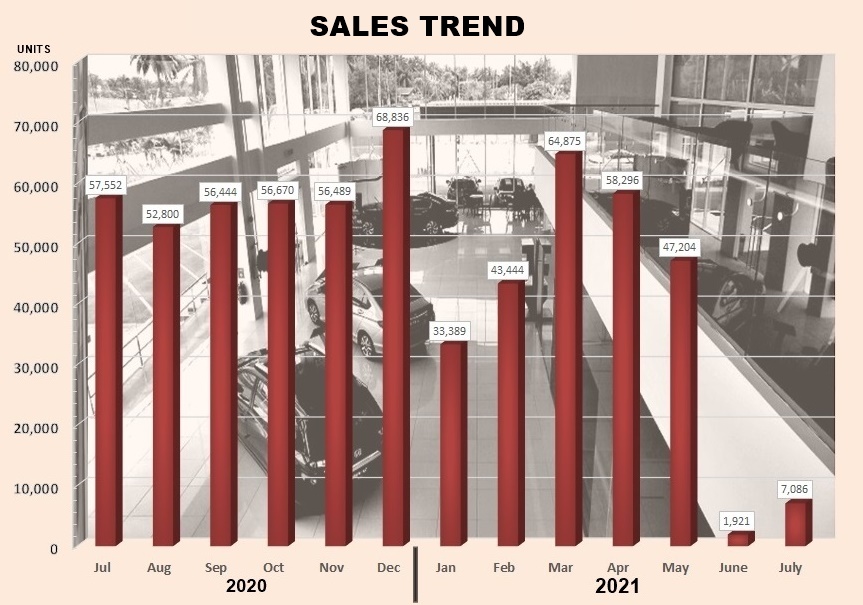

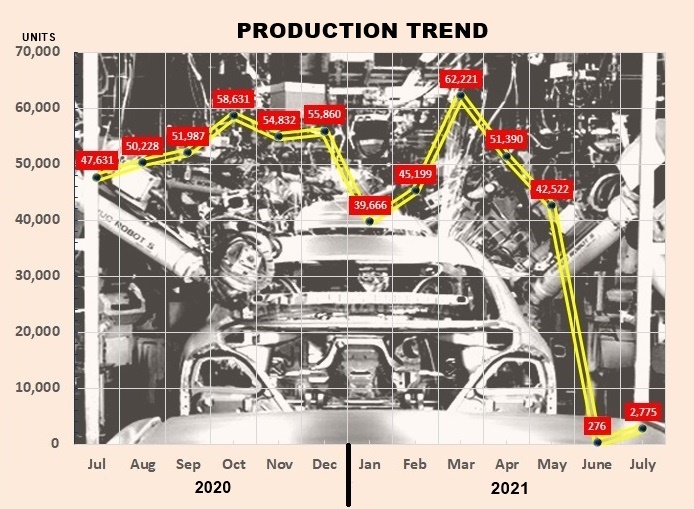

In 2020, although the COVID-19 pandemic started, Perodua was able to sell 220,154 vehicles. However, in 2021, apart from the disruption of a long suspension of business, the supply issues for semiconductors and more recently, severe floods in many states, saw the carmaker’s sales volume for the year falling by 13.6%to 190,291 units.

The drop might have been slightly more but a last big push in December managed to increase the sales volume in the final month of 2021 to 22,940 units, 13% higher than the November volume. Part of the reason for the higher volume was also due to countermeasures on intermittent supply disruption due to COVID-19 issues, enabling more vehicles to leave the two factories.

“The 190,291 registrations were below our target of 200,000 units for 2021 as the challenges in 2021 was greater than anticipated,” said Perodua President & CEO, Dato’ Zainal Abidin Ahmad. “God-willing, deliveries will further improve in the coming months.”

The Myvi, updated in mid-November, continued to be the bestselling model in the Malaysian market with 47,525 units delivered nationwide. It has taken the market-leading position for 12 of the past 15 years, with the other 3 years being taken by the smaller Axia which, together with the Bezza, dominating the country’s A-segment.

Looking at overall industry performance in 2021, Dato’ Zainal said that the Total Industry Volume (TIV) for the year would also see a similar sales impact with an estimated decrease of 23.6% to 504,536 units from the 528,172 units sold in 2020.

“Despite the lower than expected performance for 2021, our countermeasures for the impact of COVID-19 have proven successful so far as we and our suppliers are dynamically cooperating and coordinating our efforts to ensure interruptions are minimised,” he said.

“These efforts include having a ready team of personnel to take active countermeasures at an alternate site if a supplier is under lockdown and also by allocating Perodua staff to shore up any suppliers that need temporary manpower replacements,” he revealed.

“The local automotive supply chain has also taken a massive setback in recent years. However, there is a silver lining as the order bank for Perodua vehicles remains healthy as consumers are still responding positively to the sales tax exemption introduced by the government,” Dato’ Zainal said.

On the year ahead, Dato’ Zainal said that the company had offered a forecast of 240,000 units for 2022. However, this number will likely be reviewed later this month, taking into consideration the latest developments and events.

Regarding the recent Perodua Flood Assistance programme, Dato’ Zainal said about 1,675 owners have responded to the programme and their vehicles are being inspected at Perodua service centres across the country.

“The Perodua Flood Assistance programme, which was announced by the Prime Minister, December 26 2021, has drawn a lot of interest from the public. Our priority now is to work with the insurance companies as well as other our other partners to hasten any approval process needed to repair and restore the flood damaged vehicles,” Dato Zainal said.

“We understand that most of our customers rely on their Perodua for their daily activities and we will do our best to assist,” he added. Perodua is offering up to 50% discount on selected parts needed to repair flood-damaged vehicles, and there will be no charge for labour for repair work (excluding car cleaning and detailing).

Perodua owners whose vehicles have been damaged by flood can contact the company’s support line 1-800-88-5555 to get assistance, especially for towing services (terms and conditions apply). To locate a Perodua service centre in Malaysia, visit www.perodua.com.my.

Perodua offers assistance to flood-affected customers with 50% discount on selected parts